A more engaging, insightful way to manage people

What is NetSuite Human Resource Management?

NetSuite’s SuitePeople human resource management solution provides a suite of capabilities that make HR service delivery easier and more efficient for everyone, across the organisation. With a single tool to manage human resources and financials, organisations can eliminate third-party integrations, improve data accuracy, create a more engaging workforce experience and make better-informed decisions to tightly align workforce performance with business performance.

Bring Together Financial and HR Data

With HR and financial data in a single place, your company gains visibility into how workforce performance impacts financial performance.

Reduce HR Administrative Costs

Empower employees and managers to securely accomplish common HR tasks, like changing addresses, initiating promotions or viewing time-off balances, at any time.

HR is an area that’s constantly evolving - laws, rules and policies change. Having a system that’s flexible makes it so much easier to maintain your HR department.

Learn How ERP Can Streamline Your Business

Free Product Tour (opens in new tab)

NetSuite Human Resource Management Benefits

NetSuite Human Resource Management Features

NetSuite SuitePeople provides the capabilities organisations need to manage their people and HR processes, automate completion of everyday tasks and deliver an exceptional workforce experience.

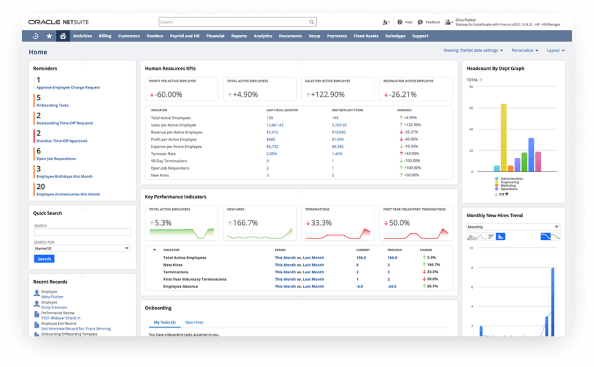

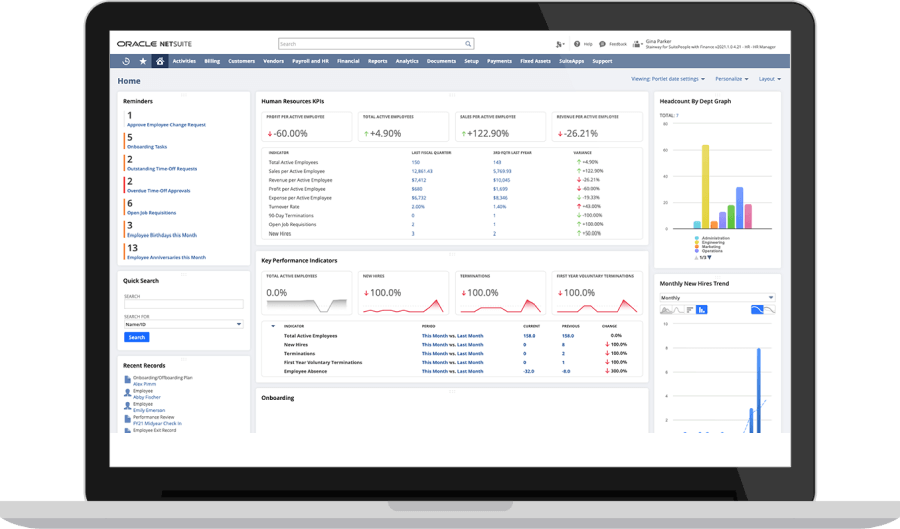

HR Administration

With workforce information shared across the Suite, human resources leaders can automate HR processes to reduce administrative time spent on common tasks and easily route information for approvals. Dashboards enable HR to monitor key KPIs and become more strategic business partners to senior leaders and hiring managers.

Employee Directory. Help employees connect and collaborate across the organisation.

Effective Dating. Create an audit trail with accurate data and change reasons to answer HR questions faster.

Access Controls. Ensure only proper changes are made, by the right people with the right permissions.

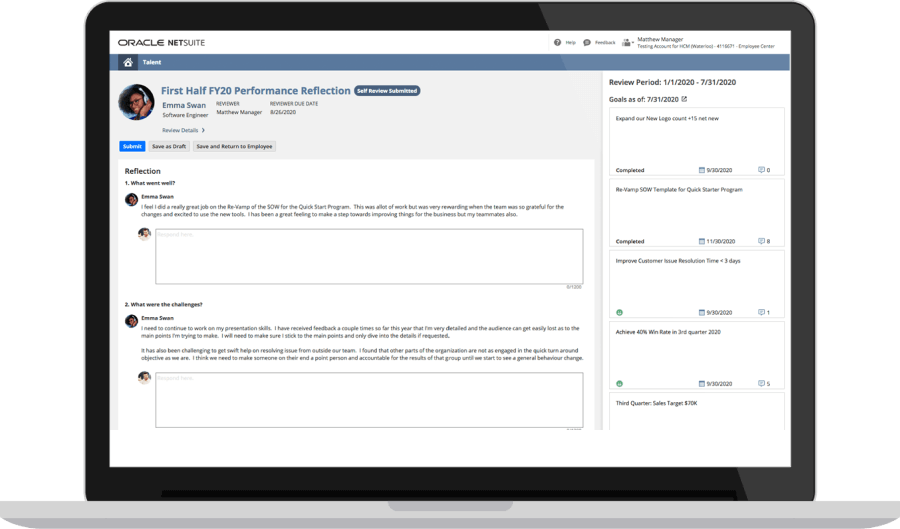

Performance Management

SuitePeople Performance Management provides a central place to easily administer the performance review process that not only delivers greater efficiency but keeps employees engaged via goal creation, progress monitoring and recognition for achievements.

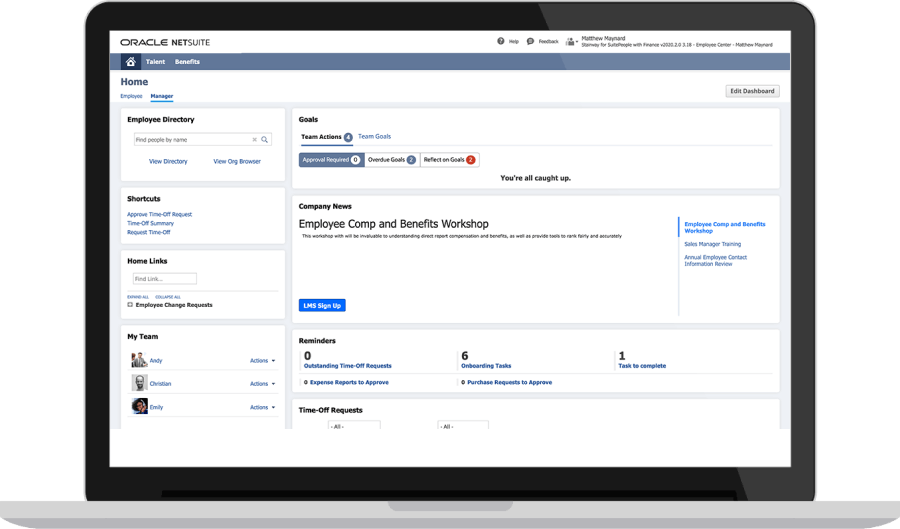

Workforce Engagement

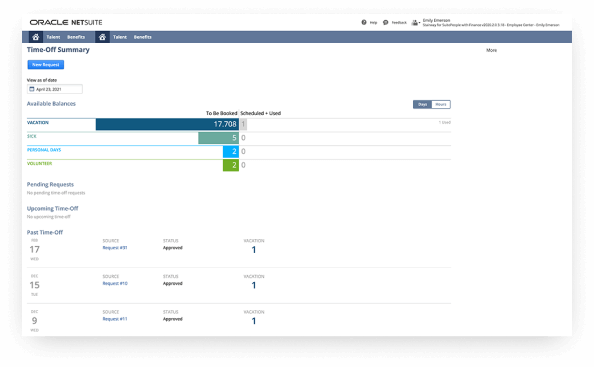

Self Service. Through the Employee Centre, both employees and managers have self-service capabilities to perform common tasks — update addresses, add bank accounts, view time off balances, monitor goal progress and see copies of paychecks and expense reports. Managers can initiate changes, such as promotions or transfers, and approve time-off requests.

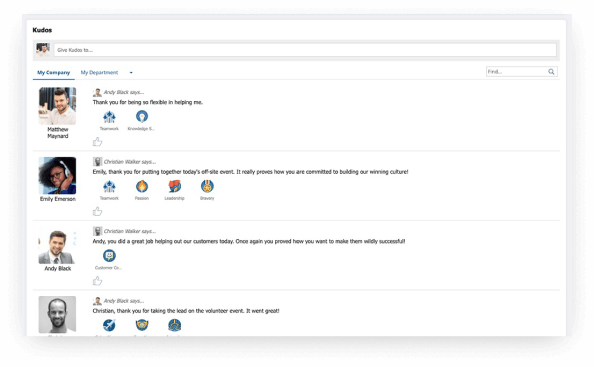

Recognition. SuitePeople Kudos provides a way to foster a positive work culture, increase retention and decrease turnover costs by enabling employees to publicly recognise their colleagues for their contributions and achievements. Use data from Kudos to build performance metrics and identify top talent during performance reviews.

Onboarding/Offboarding. Create onboarding checklists to help new hires feel welcome and be productive immediately. Integrated purchasing requests ensure employee equipment is ready on Day 1. Offboard leavers using checklists to ensure company property is returned, employees receive final paychecks and exit interviews are completed.

Analytics

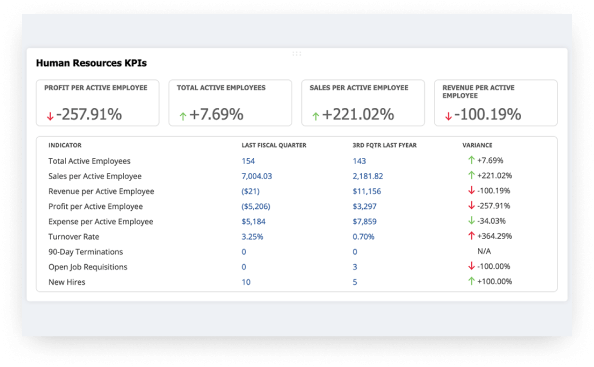

HR Analytics provides role-based dashboards for HR and other authorised users to monitor workforce performance. With 15 industry-leading KPIs, HR leaders can analyse headcount, turnover trends, demographics, revenue per active employee, expense per active employee and profit per active employee. Drill down on any of these metrics by department, employee class or group, location or subsidiary. These powerful and visual analytics help break down departmental and data barriers to improve communications for faster, more confident workforce decision-making and planning.

Challenges NetSuite Human Resource Management Solves

Faster Time to Value

NetSuite has packaged the experience gained from tens of thousands of worldwide deployments over two decades into a set of leading practices. These practices pave a clear path to success and are proven to deliver rapid business value and get you live on NetSuite in a predictable timeframe. Intelligent, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support.

How Much Does NetSuite Human Resources Cost?

Companies of every size, from pre-revenue startups to fast-growing businesses, have made the move to NetSuite. Looking for a better way to run your business but wondering about the cost?

Users subscribe to NetSuite for an annual licence fee. Your licence is made up of three main components: core platform, optional modules and number of users. There is also a one-time implementation fee for initial set up. As your business grows, you can easily activate new modules and add users — that’s the beauty of cloud software.

NetSuite SuitePeople is available as an add-on module.

Resources

Data Sheets

Access specifications, features and benefits of NetSuite SuitePeople.

Customer Stories

Spark ideas with success stories from NetSuite customers.

Product Demos

See SuitePeople in action.

NetSuite Webinars

View our on-demand webinars, which deliver insights from NetSuite and industry experts.

Guides & Blogs

Go deep into topics around NetSuite SuitePeople.

Essential Learning

Discover best practices and learn more about human resources from beginner to advanced levels.