Business leaders who adopt and maintain financial forecasting best practices are better positioned to grow — and to weather unexpected setbacks. While it’s impossible to predict the future, as the COVID-19 pandemic of 2020 has demonstrated, hedging effectively against worst-case scenarios gives the business a fighting chance to adapt.

The fact is, companies don’t end up well-capitalised, with strong balance sheets and healthy cash flows by chance. Financial health is a function of rigorous data analysis, deep familiarity with the business and up-to-date customer and market insights. Finance teams that get forecasting right in good times share in the company’s success.

In bad times, they’re darn close to heroes.

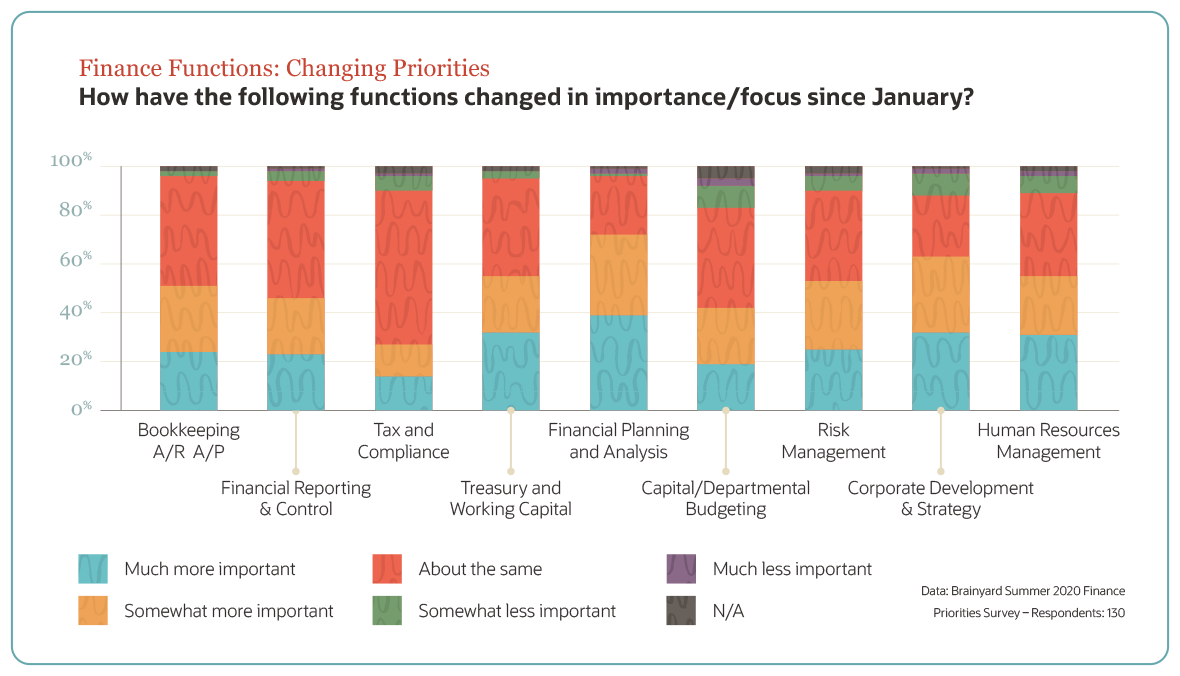

Hyperbole? Nope. Data shows that business leaders recognise the role their finance teams’ careful planning played in weathering an incredibly challenging period. Brainyard’s Summer 2020 Finance Priorities Survey showed that the financial planning and analysis (FP&A) function was seen by fully 72% as increasing in importance, often significantly, followed closely by the related corporate strategy and development. In that same survey, finance executives were much more likely to say that adding products or services is a necessary reaction to COVID-19 versus nonfinance respondents.

They can say that with assurance because they’ve done the planning.

What Is Financial Forecasting?

Forecasting is determining what is going to happen in the future by analysing what happened in the past and what is happening now. It’s a planning tool that helps businesses adapt to uncertainty based on predicted demand for goods or services.

Financial forecasting is a financial plan that estimates the projected income and projected expenses of a business, and a solid financial forecast contains both macroeconomic factors and conditions that are specific to the organisation. A thorough forecast includes but is not limited to short- and long-term outlooks on conditions that could impact revenues and contingencies for expenditures not currently viewed as necessary.

Organisations that create effective financial forecasts rely on experts skilled in creating models, whether on staff or on a consultative basis, and combine their work product with insights from people with a deep understanding of the organisation and the industries and communities it serves. Likewise, information gathering and software play a key role in the financial forecasting process.

What Skills Are Needed for Financial Planning?

Creating models requires excellent mathematical and statistical chops. In addition, teams tasked with financial planning must be:

- Comfortable diving into complex and varied data sets from sales, marketing, human resources, operations and outside sources;

- Skilled in using formulas and processes that allow them to aggregate and manipulate raw data to produce readily consumable reports;

- Familiar with ERP and other financial systems and how this software can automate reporting and assist with more complex analysis;

- Adept at communicating and collaborating with colleagues from across the organisation to understand business priorities and goals;

- In possession of deep knowledge of the company and its processes; and

- Problem solvers who can turn mountains of financial data and more subjective information into easily understood reports.

There are four standard quantitative financial forecast models: straight line, moving average, simple linear regression and multiple linear regression. All rely on data that can be measured and statistically controlled and rendered.

Financial forecasting methods may also be qualitative, relying on data that cannot be objectively measured, such as evolving customer preferences, but that’s still important to the business. You’ll also need to consider predictive modeling algorithms, which use machine learning and data mining to predict and forecast likely future outcomes

What’s the right method or combo of methods for your business? That’s based on a number of considerations.

Why Is Forecasting Important?

Financial forecasts are an essential part of business planning, budgeting, operations, funding — they simply help leaders and outside stakeholders make better choices.

A financial forecast is an estimate of future financial outcomes for a company, and it’s an integral part of the annual budget process. It informs major financial decisions, such as whether to fund a capital project, undertake a staffing increase or seek funding. Businesses use material information from their financial forecasts on their balance sheets and other disclosures.

A financial forecast gives businesses access to cohesive reports, allowing finance departments to establish business goals that are both realistic and feasible. It also gives management valuable insights into the way the business performed in the past and the way it will compare in the future. Beyond informing internal fiscal controls and decisions, financial forecasts are essential in investor relations and when seeking loans. Banks and other funders weigh forecasts in their own decision-making processes.

And startups aren’t exempt. Financial forecasts are part of any new business plan, as we’ll discuss.

Benefits of Financial Forecasting

Besides the practical benefits we’ve discussed, the process of developing a financial forecast forces finance teams and line-of-business colleagues to stop and reflect on the value of rolling forecasts.

CFOs also have some decisions to make: Do we look out a set number of months or use a rolling model? Will the forecast be iterative, building on last year’s, or will we take a page from the zero-based budgeting movement and start with a (nearly) blank slate? Which proposed new product lines have data proving viability and are worth including in a formal forecast?

Traditional vs. Rolling Forecasts

| Traditional Forecasting | Rolling Forecasting |

|---|---|

| Fixed financial plan calculated for a set period of time, typically one year, that uses historical observations to estimate future business metrics. | A “live” financial plan that is regularly updated throughout the year to reflect changes. |

| Calendar-based (annual, quarterly) | Event-based with real-time adjustments to calendar forecasts |

| Fixed targets (sales/profit, other KPIs) | Dynamic adjustments to targets based on external/internal events |

| Resource allocations are rigid | May trigger reallocation of resources based on dynamic targets |

| Manual, account-based and often linked to accounting cycles | Business-driver-based and connected to operations |

The payoffs of that work include the ability to make sound decisions even while under time constraints, being able to confidently greenlight a new capital project based on data and better success seeking credit or attracting investors.

8 Key Financial Forecasting Components

Unlike other financial data, forecasts are just that: predictions based on conditions that are subject to change. However, companies that include as many potential variables as is feasible and invest in thorough information gathering are better positioned to make reasoned assumptions with a high confidence in the forecast’s accuracy.

A financial forecast should include:

- Prior results weighted against conditions at the time: Whether you’re building a fantasy baseball roster or evaluating the performance of a product line, there are formulas to determine how much weight to give any piece of data. Remember: COVID-19 has skewed many assumptions. Look at the historical accuracy of data sources.

- A forward-looking time horizon: Again, you may choose to do a standard 12-, 18- or 24-month span; look out further; or undertake a rolling forecast.

- Full consideration of a macroeconomic risk: This includes a sudden, major global event such as a natural disaster or pandemic.

- Best-case revenue scenario: What if everything falls perfectly into place for every product and service?

- Worst-case revenue scenario: What if everything that can go wrong does? Use scenario planning methodologies.

- Anticipated expenses: These have likely changed based on a wholesale exodus from office space and will need to be recalculated.

- Worst-case unanticipated costs: What if you’re hit with a cyberattack and lose your data, or a factory is flattened by a hurricane or fire?

- Internal risks: Risk-adjusted forecasting is a practice in itself, and companies may have blind spots when it comes to identifying internal risks, like a high-level executive committing fraud. Consider, though, that crisis management experts say a company is about twice as likely to suffer from mismanagement as an external cyberattack.

The accuracy of financial forecasts can be a deciding factor in whether businesses survive the most extreme — or mundane — unforeseen events.

Financial Forecasting & Budgeting

Experts widely agree that a solid financial plan is built on both forecasting and sound spending guidance. While some use the terms “financial forecasting” and “budgeting” interchangeably, they are separate processes.

Financial forecasting is a critical first step in the budgeting process. Organisations that work hard to create reliable financial forecasts are more likely to build realistic budgets. Financial forecasting should always precede the budgeting process to ensure spending is in line with factors that can impact overall financial performance. Those who create budgets without financial forecasts are at risk of overspending and not having enough available cash for unexpected costs or shortfalls in revenue. Lacking a forecast may also keep the business from greenlighting a new capital investment or launching a product that may have ended up being a growth driver.

7 Reasons Your Business Needs A Financial Forecast

Hopefully we’ve made the case for established firms. But entrepreneurs and fast-growth companies may find that financial forecasts have an outsize effect on performance.

Maybe you don’t need to take that second round of VC cash after all.

Entrepreneurs shouldn’t let the lack of a finance team dissuade them from financial forecasting or modeling. There are plenty of CFOs for hire who can bring an experienced perspective.

An effective financial forecast will:

- Serve as the basis for budgeting decisions;

- Show investors and creditors that your organisation has a plan and is prepared for unforeseen events that may impact revenues and budgets;

- Provide a barometer for those making material financial decisions;

- Ensure that an organisation is prepared for the best- and worst-case scenarios;

- Establish controls and raise awareness of a broad range of internal and external variables that can have short- and long-term impacts;

- Help keep business leaders from being blindsided by events that could impact performance; and

- Prepare businesses for increases in demand for their goods and/or services — aka, growth.

Financial Forecasting Software

Creating financial forecasts is both easier and more complex than just a few years ago.

All sorts of data is now at our fingertips, much of it available in real time. Think buying patterns, fraud detection, real-time stock market information, customer segmentation and more. That opens up a ton of possibilities, but it also adds complexity. Forecasters must identify the right data, capture that information and incorporate it into their analysis, often using machine learning.

Fast-growth companies need tools beyond just spreadsheets to effectively gather, model and consume information. That brings us to dedicated financial management software. Look for the ability to automatically collect all the financial and operational data and KPIs in one controlled environment — when all stakeholders can access the same data set, financial forecasting and reforecasting become faster, more accurate processes.