Anyone who has done significant home remodelling may recall mixed emotions as the project kicked off: excitement about what’s to come, but also worry about whether the budget is big enough to see the project through. Similar emotions may come with the rollout of an enterprise resource planning (ERP) system. By consolidating important business functions, such as finance, human resources, customer relationship management, logistics, manufacturing and supply chain management, into a single, powerful database, an ERP system can transform a company’s growth potential. Of course, that’s only possible if the project is done correctly so that the company can take full advantage of ERP’s potential — and if it’s affordable.

That’s why, before any work begins, a successful ERP implementation requires a careful evaluation of what the company needs, what the ERP system can and can’t do, its benefits and — especially — its costs. And when it comes to costs, total cost of ownership (TCO) is the crucial measure. TCO includes the expense of purchasing ERP software but then looks beyond, encompassing the many other financial implications that go into building, managing, supporting and growing the system over the duration of its use.

TCO is not only an important step in justifying the investment in an ERP system, but it’s also a means of consistently measuring the value of the system over time. To help businesses achieve this, let’s examine what TCO is, how it assesses value and the various factors that impact ERP TCO.

What Is ERP TCO?

TCO is a measure of both the direct and indirect costs of an asset (including software) over a specific period of time. TCO is meant to look beyond the cost of purchasing an asset to determine all the other related expenses — some obvious, some not so obvious — that come into play as a result of owning it. Consider a car, for example. Purchasing a car is meaningless unless you’re able to pay for gas (or electricity) to drive it. There’s also the cost of car insurance, and, at some point, the cost of repairs to keep it running. Adding up these elements during the decision-making process preceding a purchase gives car owners a true picture of exactly how much money they’ll need to operate it for the foreseeable future. This way, they can decide whether the investment makes sense for them and, if so, how they will pay for it.

The same is true for ERP systems. Beyond the up-front cost of purchasing software, ERP systems have implementation costs, training fees, upgrades and integrations, to name a few. In particular, many of the costs of ERP systems depend on how the customer chooses to host the software. There are generally three options.

- On premises: The customer hosts and manages the ERP software on its own hardware and infrastructure, located on its property. Therefore, there are no fees associated with hosting, maintenance or upgrades.

- Cloud: The software is hosted on the ERP vendor’s hardware and infrastructure, and the vendor maintains both the hardware and the software. Customers access the software via the internet. Costs for hosting, managing and upgrading the system are included in the vendor’s per-user software subscription fees, usually charged monthly or annually.

- Third-party hosted: The software is hosted by a third-party company located off-site from the customer. Users access the system via the internet, as they would a cloud solution. Fees for managing the servers are charged monthly or annually, but, unlike cloud solutions, customers are responsible for maintenance and upgrades.

Understanding the various costs before purchasing and implementing an ERP system is critical. It ensures that a company has the necessary resources to commit to a vision for ERP that allows it to take advantage of all the system’s business benefits, including more efficient processes, a deeper understanding of companywide data and, ultimately, better decision-making.

Key Takeaways

- ERP TCO measures the full cost of using an ERP system over a period of time, including not only the purchase price, but also the costs of implementing, operating and improving the system over its life cycle.

- TCO is an important component of return on investment (ROI). ROI subtracts the TCO of an ERP system from the financial value of its business benefits, such as increased sales, reduced expenses and higher productivity, to identify the value the ERP system brings to the company.

- ERP TCO must account for hidden costs of ERP implementation and operation, including the use of internal resources to staff the project and related productivity declines that result from doing so.

ERP TCO Explained

When it comes to cloud ERP systems, the term “TCO” is a bit of a misnomer. That’s because the concept of “ownership” of a cloud-based product isn’t quite the same as with on-premises or hosted systems. On-premises ERP purchases include tangible assets in the form of software that the customer must load onto its physical hardware. Hosted solutions give customers ownership of the software but not the hardware. Cloud ERP systems, on the other hand, aren’t a physical asset, and customers don’t “own” the software or hardware; the ERP vendor manages and controls them. The customer buys subscriptions to access the software and hardware. This distinction becomes important from an accounting standpoint: Most of the costs of on-premises ERP systems are accounted for as capital expenses, while most of the costs of cloud ERP rollouts are accounted for as operating expenses. Financially speaking, each is accounted for differently over time, although a business can calculate its ERP TCO either way.

There are several reasons why ERP TCO is important to the ERP decision-making process.

- Budgeting: ERP systems are comprehensive and powerful tools that can transform how companies operate, opening up new avenues for growth. As such, they represent a considerable investment for any company. Understanding TCO allows for accurate budgeting for the life of the system, ensuring that companies are properly resourced for success.

- ROI: TCO is a key element of another important investment metric, ROI, which measures the total value of owning an asset over time. ROI involves calculating the financial value of the benefits of using an ERP system — including reductions in costs and increases in productivity, efficiency and overall growth — and subtracting the TCO. The resulting number is then divided by the TCO and multiplied by 100 to produce a percentage. The higher the percentage, the more return on the investment.

- Choosing a vendor: Because of pricing and feature differences among vendors, costs of different ERP systems may vary. Accurate TCO calculations for each potential vendor allow companies to make educated assessments about which vendor best suits their needs and budgets.

- Risk management: Unexpected expenses can signal the death knell for a project. With a system as important as ERP, no company wants to find itself without the resources necessary to take full advantage of the software’s potential. That’s why a comprehensive understanding of TCO — particularly the analysis of any possible hidden costs, such as change management resources, for example — can be the difference between success and failure.

How to Calculate ERP TCO

Broadly speaking, ERP TCO has three segments, each composed of a host of more specific components. Calculating TCO involves summing the value of all these elements into a single amount. The three primary segments of ERP TCO are:

- Purchase costs: The initial cost of many ERP implementations includes two key components, depending on how a company chooses to host its system: software and (possibly) hardware. On-premises ERP customers purchase a perpetual licence to run the software on their own internal servers (which may also need to be purchased). Cloud ERP purchases, on the other hand, are subscription-based, meaning they likely require monthly or annual per-user fees to access the software hosted on the ERP vendor’s servers. Because there are no customer-owned servers, cloud ERP doesn’t require hardware purchases. Third-party-hosted ERP, similar to on-premises solutions, requires separate expenses for software and hardware, although the latter is charged as a rental fee. For both cloud and on-premises ERP implementations, fees are also based on how many users access the system and how many ERP modules a customer purchases. Other optional purchases include additional security software or an integration platform to manage connections between the ERP system and other core systems, such as proprietary software for specific industries.

- Implementation costs: Regardless of how an ERP system is hosted, implementation costs often include consultants to help with various phases, such as vendor selection, project scoping, business process analysis, change management strategy, training and data migration. Implementation costs also cover the expenses for internal resources who commit time to the rollout. TCO calculations should include the sum of their salaries while working on the project.

- Ongoing costs: After implementation, on-premises ERP systems may require upgrades to new servers or additional devices for end users to take advantage of new functionality. Hosted ERP solutions may also require upgrades or increases in capacity as customers scale, which increases costs. For cloud ERP, server upgrades are unnecessary, but upgrades to end-user devices factor into cost projections. Ongoing costs also include people costs. On-premises ERP systems often require considerable resources to maintain and support the internal infrastructure that hosts the system, as well as to implement upgrades to the software. Those resources aren’t necessary for cloud-based ERP because the ERP vendor handles those responsibilities as part of its subscription fee. Both options, however, will likely require consistent training of staff as new functionality gets added to the system.

Unfortunately, not all the elements that constitute the above three categories are obvious. That’s why companies need to also consider the hidden costs of ERP systems before moving forward. Failure to do so can result in companies needing to scale back their ERP plans or, in extreme cases, halt them altogether because they can’t afford them.

ERP TCO Formula

As formulas go, the one for calculating ERP TCO is relatively simple: Identify all the costs accrued over time that are associated with purchasing, implementing and maintaining an ERP system and add them up. Of course, in practice, it’s more complex than that, because the costs of an ERP system are extensive and not always immediately apparent. One important factor in any ERP TCO calculation is the time frame. In most cases, companies tend to evaluate TCO over a period of five to 10 years, which is a presumption of the expected life span of the system before it needs to be replaced. That presumption, however, doesn’t apply to cloud ERP systems, since “replacement” isn’t a consideration. In cloud ERP TCO calculations, buyers must choose the time frame they wish to reference.

The formula for TCO, in its simplest form, is:

TCO = Purchase price + implementation costs + operating costs for the next 5 to 10 years

Understanding Hidden Costs

While the TCO formula itself may be simple, the ERP challenge lies in assessing the many possible factors that can influence the total cost of ERP evaluation, implementation and ongoing operation. Costs for ERP systems fall into two categories: hard and soft. Hard costs, also known as direct costs, are tangible and easily quantifiable, such as those for software licences or subscriptions and, in the case of on-premises ERPs, servers and other infrastructure. Hard costs can also include the cost of consultants for various stages of the implementation.

Soft costs, also known as indirect costs, can be less obvious and quantifiable, although an accurate TCO must account for them. Soft costs are often people-related, such as the cost of productivity declines as a result of moving employees away from their daily responsibilities to work on an ERP implementation project team. Soft costs are also often referred to as hidden costs because they’re easily overlooked. When calculating TCO, the following hidden costs should always be factored into the equation.

- Implementation time and people costs: The people cost associated with the implementation of an ERP system — meaning the cost of reassigning internal staff resources from their existing roles to an ERP implementation role for the duration of the rollout — is one of the more commonly overlooked soft costs in a TCO calculation. Internal resources are often reassigned to ERP implementations to contribute to project management, building, testing and training, for example. TCO should include the cost of backfilling those job functions, or it should include the cost of the impact of those lost resources, such as productivity declines or delayed customer service response times. Calculating accurate people costs requires companies to understand how much time they need to dedicate to ERP projects and to allocate those people costs for the entire duration. That’s why it’s critical to understand the full scope of the implementation from the outset, including knowing how many ERP modules, how much data migration and how many customisations and integrations will be involved.

- Ongoing people costs: Post implementation, on-premises ERP systems require resources for ongoing maintenance, upgrades and support. TCO calculations should include the cost of staffing needed for IT, business processes, training, end-user support and project management for any necessary maintenance, support and upgrade initiatives. Some of these expenses won’t factor into cloud ERP TCO. In particular, maintenance, support and upgrades are handled by the ERP vendor as part of its cloud subscription fees. But business processes, training and some IT support will likely be necessary for cloud ERP, either from internal teams or consultants.

- Ongoing infrastructure expenses: Ongoing infrastructure costs for ERP systems differ, depending on the deployment method: on-premises, cloud or hosted. For on-premises systems, upgrades to the system may require new servers, networking infrastructure, storage space or databases, for example. With hosted solutions, servers are maintained by a third party, but upgrades to server functionality or capacity may add costs. Cloud ERP systems, though not requiring servers, still may have infrastructure implications to consider, such as networking and end-user device upgrades. Both on-premises and cloud ERP systems may also require additional hardware or software for backup and disaster-recovery purposes, which should also be factored into TCO.

Factors That Affect the TCO of an ERP System

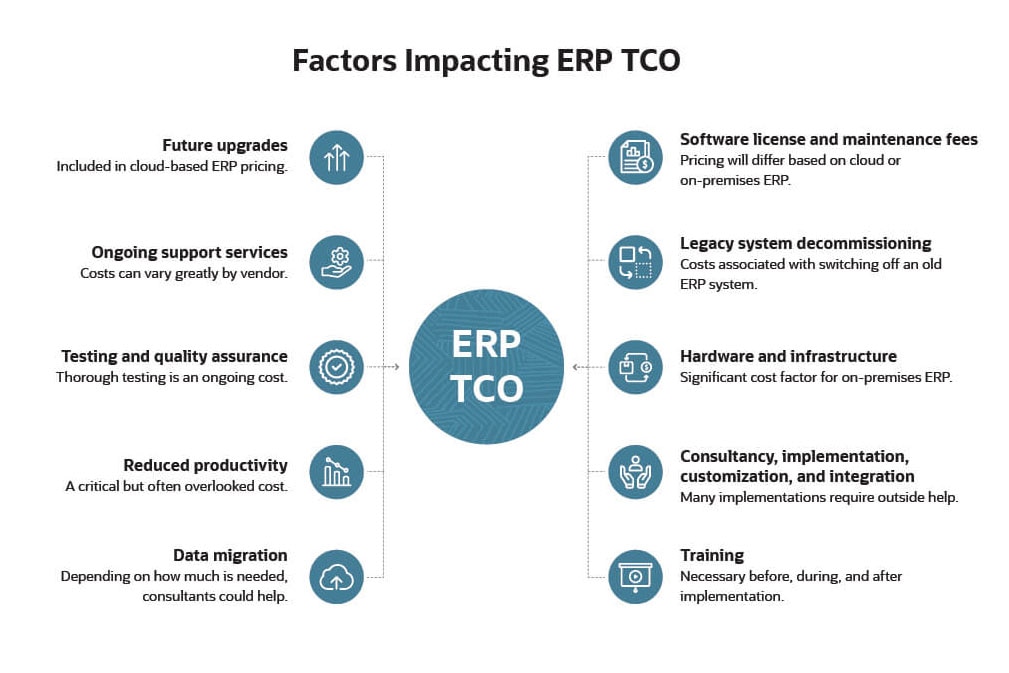

ERP TCO comprises three broad segments — purchasing costs, implementation costs and ongoing costs (also known as carrying costs) — but there are a number of subcategories to consider as part of overall TCO. These include:

Software Licence, Subscription and Maintenance Costs

Software costs are one of the core elements of ERP TCO and also among the easiest to calculate, although amounts depend on how the customer chooses to host its ERP software. For on-premises ERP, a single perpetual licence fee gives customers the right to host the software on their own servers. In a hosted ERP solution, the perpetual licence pertains to third-party-hosted servers (not the customer’s or the ERP vendor’s), which are accessed through the internet. Cloud ERP systems are hosted by the cloud ERP vendor, and customers must pay monthly or annual subscription fees (which are not the same as licence fees or hosting fees). Licence and cloud subscription fees both usually depend on the number of users of the system. So, when calculating ERP TCO and building the business case, be sure to consider not only the cost of current requirements for the number of users but future needs, as well.

Software maintenance covers the cost of troubleshooting problems with on-premises and hosted ERP systems. Cloud-based ERP doesn't require software maintenance, however, because vendors maintain their software on their servers and include maintenance as part of the subscription price.

Legacy System Decommissioning Costs

Implementing a new ERP system often means replacing an existing ERP solution, or multiple separate legacy systems, and that cost should also be incorporated into a TCO calculation. But decommissioning isn’t as simple as flipping a switch. First and foremost, legacy system data needs to be migrated to the new ERP system. Companies often use consultants for this process if in-house resources aren’t available. In addition, companies may choose to run legacy systems in parallel with new ERP systems as a backup mechanism in the early stages of implementation; some components of legacy systems may continue operating for longer periods of time. Be sure to consider any costs associated with maintaining and, ultimately, sunsetting those systems after your new ERP system is deployed.

Hardware and Infrastructure Costs, Including Hosting Fees

Hardware and infrastructure costs are a sizable component of TCO for on-premises and hosted ERP systems, but pricing methods vary. On-premises ERP systems often require hardware and infrastructure expenses up front, though some companies may be able to repurpose existing equipment. Hosted ERP systems also include hardware and infrastructure costs, although fees will likely be billed via monthly or annual subscription by the third-party hosting provider. For cloud-based ERP, however, hardware and infrastructure costs are minimal at most, because cloud ERP vendors host and maintain the system on their own infrastructure and include the cost for that service in their subscription fees. Regardless of hosting method, any ERP system might require additional hardware purchases, such as new networking infrastructure for faster connectivity or upgrades to end-user devices to access the ERP system. Hardware to support backup and disaster recovery systems may also factor into ERP TCO.

Consultancy, Implementation, Customisation and Integration Fees

Because cloud ERP implementations don’t involve hardware, they tend to be simpler and take less time to get up and running. But no ERP implementation is as simple as the flip of a switch. That’s why many companies use consultants for various phases of ERP implementation and operation, including vendor evaluation, business process assessment, project management, data migration, training and testing. Consultants also commonly help customise ERP systems to meet customer needs, such as company-specific policies and workflows or industry standards for financial reporting. Customisations also commonly include integrations with other core systems to further consolidate important data into an ERP system’s central database. Whether these projects are completed by consultants or internal resources, ERP TCO calculations should factor in the costs related to using those resources.

Training Costs

ERP training goes beyond training end users once the new system is deployed. As a critical means of ensuring that users of an ERP system support and embrace the new technology, training should start during the implementation phase and continue regularly, as new features are added to the system. There are several options for managing training. In many cases, ERP vendors offer training services for a fee; consultants are another option. There’s also a hybrid solution in which consultants train key members of an internal team, who then take responsibility for educating the rest of the company. Regardless, consistent training budgets are a core element of ERP TCO.

Data Migration Costs

Data migration is one of the most critical aspects of a successful ERP implementation, and it factors heavily into any ERP TCO. Data migration involves many phases, including data analysis, mapping, cleansing, extraction, loading, validation and testing. If companies are replacing a legacy ERP system, data needs to be migrated from the older system to the new one. If there is no legacy ERP system, companies still often have data in other systems, such as proprietary claims systems in the insurance industry, that needs to be migrated to the ERP system. Larger organisations may be able to handle data migration internally, but many companies rely on consultants. ERP TCO should include the cost of consultants, or the salaries of any internal employees committed to the project.

Short-Term Reduced Productivity Costs

Productivity issues during an ERP implementation are one hidden cost that should always be factored into TCO. If companies are able to hire them, consultants can play a large role in deploying an ERP system, but internal teams will always play a significant role in assessing, managing and building the system. In many cases, employees get reassigned to ERP tasks, for example, to a vendor selection committee. Some projects are brief, while others, such as project management, can be protracted. And while salaries for staff members don’t often increase when they contribute to an ERP rollout, TCO must consider the possible consequences of how the ERP project impacts employees’ abilities to accomplish their “day jobs.” If customer service representatives contribute to an ERP project on a part-time basis, what’s the cost of potentially delayed customer response times that may result? ERP TCO must estimate those costs or include the cost to backfill the jobs of those who temporarily work on ERP rollouts. One way to assess the cost of productivity losses is to estimate weekly hours lost to core responsibilities, either as a result of the ERP project itself or because of distractions from the project. Converting employee salaries to hourly rates, then multiplying by the lost hours, provides a dollar estimate of lost productivity.

Testing and Quality Assurance Expenses

Testing and quality assurance costs for ERP systems are ongoing elements of ERP TCO. As with many aspects of ERP implementation and management, both responsibilities can be handled internally or by consultants. The cost of testing and quality assurance depends on how comprehensively companies approach the tasks. Complete testing programs include building a testing framework, setting up a test environment, functional testing of the system to ensure that it meets business requirements, performance testing, user acceptance testing, regression testing to gauge the impact of changes to the system, and quality assurance to maintain security, reliability and scalability. TCO should include the costs for testing and quality assurance, whether they’re handled internally or through consultants.

Ongoing Support Services Charges

ERP system support can take many forms, and all of them should be considered part of a TCO calculation. Some costs relate more to on-premises and hosted ERP systems, particularly maintenance and upgrades, which are the responsibility of the customer and thus require that staffing and related costs be factored into TCO. Cloud ERP vendors, on the other hand, maintain and automatically upgrade systems for customers, often as part of the fees customers pay. All ERP systems, including cloud, require technical support to handle issues like bugs, performance problems or downtime. ERP vendors often provide these services, as do consultants, although fees may be involved and can vary. Be sure to understand all support fees before implementing an ERP system.

Future Upgrade Costs

Upgrades to ERP systems are handled differently for on-premises and hosted systems vs. cloud-based systems. For cloud ERP, upgrades are included in subscription fees, and customers foot the bill only for testing to ensure any customisations remain compatible. Vendors automatically push those upgrades to customers via the cloud. Some new features, however, may require additional costs, so it’s important to understand how each ERP vendor deals with them. Upgrades can also include additional ERP modules. For example, a company may launch its ERP system with a focus on financial systems but may look to add human resources at a later date. And although future subscriptions aren’t technically an upgrade, cloud ERP customers should be sure to consider how much additional users will cost, based on anticipated company growth. On-premises ERP vendors also provide upgrades as part of their services, but the cost of implementing those upgrades, whether on a customer’s internal servers or third-party hosted servers, is ultimately the responsibility of the customer and can represent a considerable chunk of ERP TCO.

Carrying Costs

Carrying costs represent another way to view the continuing costs of maintaining and running an ERP system, such as training, ongoing support services, maintenance and testing. For the purposes of this article, these costs have been captured in more specific categories, as appropriate. Some companies, however, prefer to consider them together under the broad category of carrying costs.

ERP TCO Example

To better understand how to calculate ERP TCO, consider the example of a small to medium-sized business looking to purchase a new cloud ERP system. To calculate TCO, the business will need to understand the hard and soft costs related to purchasing the software, as well as the price of implementing and maintaining the system for five years. Keep in mind that this example has been simplified to fit in this article and that the numbers are hypothetical; actual amounts will vary depending on the specifics of the individual customer.

- Number of employees using the ERP: 15

- Increase in number of users per year: 2

- Software subscription fee: $1,200 per year per user

- User-device hardware upgrades: $5,000 per year

- Implementation consultants:

- Change management: $20,000 total

- Data migration: $10,000 total

- Cost of temporary resources needed to backfill reassigned internal staff: $10,000

- Estimated employee hours lost to ERP implementation: 100

- Average hourly wage of employees whose productivity is impacted: $30

- Total support costs: $5,000 per year

- Ongoing training costs: $3,000 per year

Estimating purchasing costs first, the business calculates the number of user subscriptions required over five years, then multiplies that result by the annual per-user subscription fee. Accounting for the increase in users each year yields a total of 95 annual user subscriptions (15 + 17 + 19 + 21 + 23). Multiplying 95 times $1,200 results in total subscription fees of $114,000 over five years. Device upgrades are also part of the up-front purchase cost, adding $25,000 to the total ($5,000 per year over five years). The total purchase cost comes to $139,000 ($114,000 + $25,000).

Next, the business adds implementation costs, which include $30,000 in consultant fees and $10,000 in temporary resources. But there’s also the cost of lost productivity during the implementation. With 100 hours lost, costing an average of $30 per hour, that’s another $3,000. Adding these together provides a total implementation cost of $43,000 ($30,000 + $10,000 + $3,000).

The ongoing costs of operating the ERP system over five years include $25,000 in support costs ($5,000 per year over five years) and $15,000 in training costs ($3,000 per year over five years). The total ongoing cost is $40,000.

To arrive at the final, five-year TCO for this implementation, add $139,000 in up-front costs, $43,000 in implementation costs and $40,000 in ongoing costs for a total of $222,000 over five years. Again, costs for ERP systems vary widely depending on many factors, among them the size of the implementation, number of modules, availability of resources and customizations.

Reduce Your ERP TCO With a Known Entity: NetSuite

Compared to on-premises ERP, cloud-based ERP systems usually lower TCO by simplifying processes for implementation, maintenance and updates. Because cloud-based ERP vendors host, maintain and upgrade the system, hardware and networking infrastructure purchases are removed from the equation. For the same reason, cloud systems also simplify implementation and maintenance of the system, requiring fewer resources and further reducing cost.

NetSuite ERP includes several unique features that help reduce TCO further. Because it was designed to be a single, integrated application spanning front office, back office and ecommerce — with modules for financials, customer relationship management, business intelligence, inventory and order management, human resources, professional services automation and supply chain management — NetSuite ERP requires less integration with other systems. Less integration makes the implementation process faster and less expensive. If a customer does require integrations and customisations, NetSuite SuiteCloud Platform makes extending and customising NetSuite faster and simpler to adapt to each customer’s unique business model.

Speed of implementation is another highlight of NetSuite that reduces TCO. The NetSuite SuiteSuccess customer engagement model deploys the ERP system faster and incorporates leading business process practices to reduce implementation time and cost, while speeding time to value. NetSuite also reduces the need for additional security solutions by employing stringent round-the-clock monitoring tools, controls and policies, as well as a dedicated security team.

Total cost of ownership is a key means of gauging a company’s cost to take advantage of the potential benefits of ERP systems. TCO is an important piece of the ERP evaluation process that can be incorporated into regular ROI assessments to ensure that ERP investments continue to deliver efficient business processes and improved decision-making.

#1 Cloud ERP

Software

ERP TCO FAQs

How is TCO calculated?

As a formula, ERP total cost of ownership (TCO) = purchase price + implementation costs + operating costs for five to 10 years. While the math may seem simple, in practice TCO is more complex, because the costs of an ERP system are extensive and not always immediately apparent. One important factor in any TCO calculation is the time frame. In most cases, companies tend to evaluate TCO for five to 10 years.

How can businesses avoid TCO surprises when implementing a new ERP system?

To avoid ERP total cost of ownership (TCO) surprises, consider both the hard (or direct) costs, such as licence/subscription fees, and the soft (or hidden) costs, such as the cost of employees’ time as they contribute to the project. Because ERP implementation requires staffing resources to be successful, consider the cost of declines in productivity during the implementation, as well.

How can my business use TCO to negotiate with ERP vendors?

ERP vendors often have different pricing models for their systems. Not only do licence and subscription fees often differ, but many vendors have varied models for customer support, for example. Using total cost of ownership (TCO) to understand the implications of these cost differences is an effective means of negotiating with ERP vendors. Applying TCO calculations to each solution should yield better cost comparability from solution to solution, giving companies more leverage in side-by-side negotiations.

How can I get my team on board with reducing ERP TCO?

Reducing ERP total cost of ownership (TCO) is a great way to increase return on investment (ROI), but it requires a concerted effort. Start by educating the team on why TCO is critical to help get maximum value out of the ERP system. Next, involve your team in setting realistic, achievable TCO reduction goals, then set up metrics to monitor their progress. When those goals are reached, reward the team by recognising their contributions. Finally, be sure to provide training for the team on how to use the ERP system more efficiently.

Why is it important to consider TCO while deciding on which ERP to buy?

ERP total cost of ownership (TCO) is important for many reasons. During the ERP vendor evaluation process, calculating TCO allows companies to make educated assessments about which vendor best suits their needs. ERP TCO also allows companies to accurately budget for the life of the system, ensuring that it’s properly resourced to succeed. TCO is a key element of return on investment (ROI), which measures the total value of owning an asset over time. Finally, because TCO assesses both the direct and indirect costs of ERP systems, it helps companies manage the risk of unexpected expenses.

What is an example of TCO?

Let’s say a small company implementing a cloud ERP system wants to calculate total cost of ownership (TCO) for five years. In this simplified example, the company needs five ERP user subscriptions at a cost of $1,200 per year per user. It also needs a consultant to help implement the system, at a cost of $10,000. Add to that a team of trainers to help get users up to speed and to train them on upgrades each year, at a cost of $12,500 over five years. Finally, the implementation project will require the company to commit five full-time employees to the implementation project. To backfill those job functions during implementation, the company will need to hire temporary personnel at a cost of $10,000. TCO would equal $30,000 for subscription fees ($6,000 per year over five years) + $10,000 for consultants + $12,500 for training + $10,000 for temporary backfill staff, for a total of $62,500.