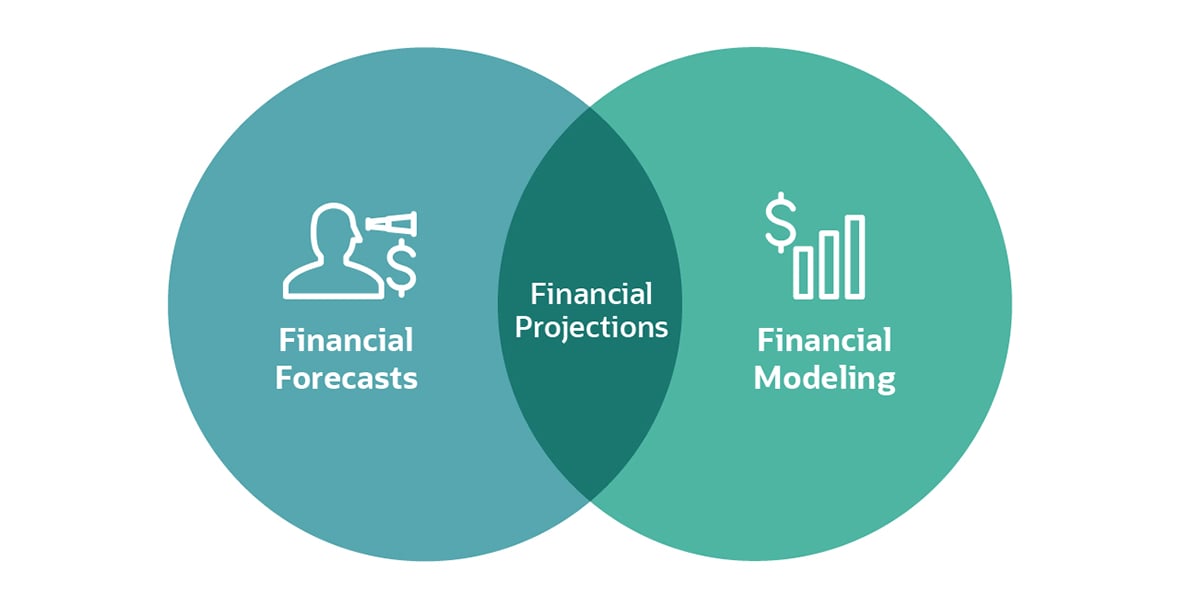

Financial projections and financial forecasting provide a view into the future financial health of your startup. The terms are sometimes used interchangeably, but there are key distinctions that make one a better tool for guiding internal decision-making and the other the best way to show investors and lenders that your business deserves their confidence.

Both disciplines use current and historical transactional data, coupled with information on market conditions and industry trends, to predict what a startup’s journey may look like and whether it’s on track to meet its intended targets.

But while financial forecasting predicts events that are likely to happen, financial projections are used to present and examine hypothetical scenarios. According to the American Institute of Certified Public Accountants Standards Section 301, forecasts present the assumptions that reflect conditions the business expects to exist and the course of action it expects to take. Financial projections, on the other hand, allow financial professionals to model hypothetical “what if” scenarios.

Market analysts and financers often want to see “what if” scenarios so they can ground their decisions in data when evaluating whether to invest in or lend to the startup.

To complete financial projections, startups can use current and historical financial statements and external market information such as reports from government agencies such as the Department of Labour or market and industry projections from consulting firms. Revenue projections give investors and lenders a sense of how much you will sell by modelling out how it impacts operating expenses, for instance, on the income statement. Cash flow projections show where you will get that money—from receivables, loans, a line of credit, etc. Profit and loss projections help investors assess the growth potential of your business, while a balance sheet projection can suggest the rate of return on an investment in your company.

Taken together, financial forecasts and financial projections provide a toolset for a startup to not only react to imminent potential scenarios but also anticipate more far-fetched ones. With clear, data-based definitions around targets, a startup will know when, for instance, its selling expenses are outpacing revenue growth, and make adjustments.

Why Do I Need a Financial Model?

To get financial projections for a startup, you must use a financial model—often an Excel-based tool that brings in data from current financial statements and market trends to project how those statements may look in the future. Financial modeling produces financial projections by taking financial forecasts and playing them out.

In order to make financial projections, you will first need to gather your financial statements, decide on the scenarios you’d like to play out and, most importantly, build a financial model to do the work. You can build these basic financial models in Excel with the help of a finance expert.

The spreadsheet-based formulas allow you to play out different assumptions and see how different variables will impact line items and ultimately business plans. Financial projections can be completed across all three financial statements: your income statement/P&L, your balance sheet and cash flow statement. With projected financial statements, you can complete scenario planning.

Financial projections provide specific targets to drive performance and help a company achieve its goals. They also give lenders and investors a sense of the company’s long-term financial prospects, increasing their confidence in the business. Above all, these projections give the startup a much better idea of the impact of external factors on its financials and the investments it needs to make to achieve its business plan.

When Do I Use Projections?

Financial projections are used internally to show the effects of internal business decisions and external market conditions. For instance, what would happen if you added a new line of hand sanitizers in the fall? How would it affect the production of other products? How would that affect revenue and profit? And what external conditions need to be considered?

Executives within the company use financial projections to make decisions about raising capital, pursuing an acquisition or divestiture, opening new stores or entering new markets. They also use them to prioritise projects, establish budgets and plan for the future. Financial projections help a startup see the big picture and zero in on moves that best align with the company’s business plan, helping define its strategy moving forward.

Outside the company’s proverbial four walls, financial statements demonstrate business performance to shareholders, investors and lenders while financial models and projections help estimate and justify performance targets. For this reason, financial projections are crucial for startups. When investors and lenders can see how certain business plans play out in terms of your startup’s future financial health, they have more information with which to make financing and investing decisions.

What Is Included in a Financial Projection?

Financial projections can be short-term, which cover one year and each month thereafter, or mid-term, which cover three years and are broken down year by year. A financial projection generally takes into account your startup’s business model, goals and objectives, along with income tax planning, business insurance and investment vehicles.

To project financial statements—projected financial statements are also called “pro forma” financial statements—you’ll need past and current statements. These include the income statement/profit and loss statement (P&L), the balance sheet and the cash flow statement. These financial statements provide a sort of common language among companies, banks, investors, regulators and anyone who needs to understand the company’s financial performance, according to Ernst and Young.

- The P&L shows: Performance metrics such as gross revenue and net profit. A P&L statement also provides important details that can be used to calculate key metrics like EBITDA (earnings before interest, taxes, depreciation and amortisation), which gives investors insight into operational performance of a company so they can compare its efficiency with that of other companies. The P&L can be used to compare time periods, budget vs. actual performance and performance against other companies. It can indicate overall weak or strong performance.

- The balance sheet shows: Tangible assets a company owns (the computers, the building, etc.) and everything it owes (its debt or liabilities) over a specific time period, as well as receivables, which aren’t technically “owned” until they have been converted into cash. The difference between the value of the assets and liabilities on the books represents shareholder equity, which can consist of stocks, retained earnings or other forms of income.

- The cash flow statement shows: All cash going in and out of a company over a specific time period. The cash flow statement includes the three types of cash flow: operating activities, investing activities and financing activities. Operating cash flow measures the amount of cash generated by normal business operations. Investing cash flow measures cash coming in or out of the business from its long-term or capital investments. Financing cash flow measures cash coming in from financing transactions such as debt, equity and dividends.

Negative or positive cash flow gives investors a better sense of your overall cash position. They are looking for indicators that point toward the sustainability, solvency and growth potential of the business. Projected profit and loss statements give them an indication of whether you’ll bring in enough money to cover anticipated expenses. The projected balance sheet estimates your future financial position, which helps them determine the worth of your startup.

Investors use actual financials to assess the current value of shares and projections to estimate the future value of those shares. This helps in determining a potential return should they decide to invest in the company.

How Do I Build a Financial Projection?

To build a financial projection, you need to have accurate, easily accessible information on your past and current finances. Start with the income statement. You’ll need a strong and reliable picture of your revenue, your cost of goods sold, how much you’re spending on R&D, the cost of operations or SG&A (selling, general and administrative expenses), operating income or operating loss and the value of current assets, such as cash, receivables, inventory, investment income, etc.

Building a financial projection is challenging. Oftentimes, the hardest part for startups is getting the numbers themselves.

According to Ernst and Young, there are two ways to get those numbers: based on the market share you want to capture (top-down) or based on the resources at hand and the current data (bottom-up). EY recommends using bottom-up forecasts in the shorter term of one to two years and top-down in the longer term of three to five years. Used together, the two offer a healthy balance between ambition and realistic chances to capture market share.

To build a financial model, you will need at least three years of historical data, and The Journal of Accountancy provides a comprehensive list of financial data and metrics to include.

Complete this process for every financial statement. Model “what if” scenarios to keep independent variables constant, while looking at the metrics that would be affected if, say, you added a new product line and needed more people to sell it, more equipment to manufacture it and more supplies with which to make it.

#1 Cloud

Accounting

Software

8 Tips for Valid Startup Financial Projections

Startups should complete financial forecasting and financial projections with a few tips in mind.

- Know your audience. Remember the difference between a financial forecast and a financial projection, with the latter being particularly useful for investors and lenders who will be looking at your company from the outside.

- Get your house in order. Getting easy access to accurate historical and current financial data with which to model is often the most challenging part. Bad data won’t produce an accurate forecast and weakens the confidence of investors and lenders. Start with a reliable source of transactional data.

- Start with spend. In general, it’s much easier to predict your expenses than your revenues. Start building your forecast model by outlining your burn rate and fixed operating expenses: things like rent, utilities and insurance.

- Don’t be too conservative (nor too aggressive). Investors like to see both aggressive and conservative scenarios. Model both optimistic and cautious scenarios in financial projections, especially if the business environment is uncertain.

- Don’t let financial projections become static. Constantly reassess your financial projections and add new assumptions for modeling your growth rate. Projections without constant care become static and irrelevant.

- Be honest. Be absolutely clear about cash flow, and make sure it’s consistent across your financial statements.

- Look outside. Researching industry trends is essential to producing credible financial projections. Constantly compare your projections with those of other businesses in your industry.

- Get help. Producing regular financial statements can be difficult for startups, which means projecting financial statements can be very challenging. A CPA or a financial leader like a CFO is critical, as is software that automates the process.

Keeping accurate and easily accessible information on the current financial health of your startup is the first step to making good business decisions. But seeing the possible impact of business plans—and allowing key stakeholders to do so too—empowers you to execute sustainable and profitable plans.