For many businesses, the price of growth is complexity, and perhaps nowhere is that more apparent than with their technology. As companies add more employees, customers, product lines and service offerings and expand to new markets, the separate systems they use to manage their operations can quickly become a tangled web of tools and databases — resulting in encumbered processes, redundant efforts, siloed data and the high cost of maintaining many disparate systems. Enterprise resource planning (ERP) solutions help tame that technology beast, but finding a solution that suits a company’s specific needs is no small endeavour. This article gives businesses a head start by comparing the ERP systems of six leading vendors: NetSuite, Microsoft, SAP, Sage Intacct, Deltek and Epicor.

Which ERP Is Best for My Business?

As with any type of technology, choosing the best ERP system ultimately depends on a business’s distinct needs in terms of features and functionality, customisations and integrations, and method of deployment, be it on premises, cloud-based or a hybrid of the two. According to Panorama Consulting Group’s “2023 ERP Report,” nearly two-thirds of organisations select a cloud-based ERP, up from 53% in 2021.

An ERP system’s design is also an important factor. Most ERP systems are modular, meaning that individual business functions — such as accounting, marketing and ecommerce — plug into the platform as separate components, or modules, pertinent to the business. Some ERP providers bundle modules as a complete package for purchase; others offer modules individually, so that companies can add individual capabilities as needed. The appeal of either approach often depends on a company’s size, budget, future ERP needs and overall growth plans.

On a more technical front, modules are either native or non-native to their ERP solutions. Native modules use the same codebase and database as the ERP, allowing for simple, seamless integration without the need for additional resources, such as middleware technology or external consultants. A natively integrated ERP system delivers a single view of companywide data for real-time analysis, which is especially attractive to customers that require a wide range of capabilities within a unified system.

Non-native modules, which are typically applications acquired by the ERP provider, use codebases and databases that differ from those in the rest of the ERP system. Some customers prefer the non-native ERP approach for its flexibility to integrate outside modules or third-party applications, considering it a best-of-breed strategy. However, ERP integrations require additional effort and cost, and separate databases can hinder real-time data access.

Key Takeaways

- As companies grow, ERP solutions offer a way to simplify complexity and unify business operations, data and processes.

- Most ERP solutions offer capabilities for finance, HR, CRM, manufacturing and supply chain management, though each ERP provider’s depth in those areas varies.

- ERP providers also differ in how they offer those features, with some relying on integrating separate modules and others offering more comprehensive, natively integrated solutions.

NetSuite Overview

NetSuite launched the market’s first cloud-based ERP system in 1998, based on founder Evan Goldberg’s vision of building a unified suite of applications to replace the many disconnected systems that companies traditionally used to run their businesses. At the time, the company was known as NetLedger. In 2002, it was rebranded as NetSuite, secured a $125 million investment from mentor and Oracle founder Larry Ellison (who had initially encouraged Goldberg to start the company), and Zach Nelson became CEO. Five years later, NetSuite went public at a valuation of more than $1.5 billion. NetSuite’s evolution came full circle in 2016 when Ellison bought the company for $9.3 billion, making it a global business unit within Oracle.

Today, NetSuite offers a comprehensive ERP system with 13 natively integrated modules that support back- and front-end functions, including finance and accounting, human resources (HR), customer relationship management (CRM), manufacturing, supply chain management (SCM), professional services automation (PSA) and ecommerce. At the system’s core is a single, unified database that consolidates data from across the company in real time and, when combined with advanced reporting and analytics tools, provides an end-to-end view of the business that leads to more informed decision-making. Another important advantage is that the entire organisation works from the same set of clean, consistent data.

NetSuite ERP allows for significant customisation, enabling customers to create automations that streamline their processes and workflows. NetSuite also includes tools to build third-party integrations with its platform, as well as a network of 600-plus partner applications suitable for seamless integration.

NetSuite has a customer base of more than 36,000 small, midsize and large businesses across the Americas, Europe, the Middle East and Africa (EMEA) and the Japan and Asia-Pacific (JAPAC) region. The company handles more than 500 million application requests per day and supports 29 languages, with native tax solutions for 54 countries.

Microsoft Overview

Microsoft offers two ERP solutions under the Dynamics 365 brand: Dynamics 365 Finance targets midsize to large organisations, while Dynamics 365 Business Central targets small to midsize businesses. Both solutions are largely comprised of applications built by companies Microsoft acquired starting in 2001. The acquired products were brought to market as on-premises solutions under various names until they were consolidated into the two offerings and extended to the cloud, with Dynamics 365 Finance launching in 2016 and Dynamics 365 Business Central in 2018.

Dynamics 365 Finance is a comprehensive ERP solution with strong support for finance and SCM, in particular, and with modules for CRM, HR, ecommerce and more. Given that Dynamics 365 Finance was born of multiple acquisitions, some modules, such as CRM and payroll, use different codebases, thus requiring further integration and incurring additional cost. Dynamics 365 Finance is a partner-sold, implemented and supported solution, meaning customers deal primarily with third-party consultants. EMEA customers represent the largest slice of Dynamics 365 Finance customers, followed closely by the Americas and, to a lesser extent, JAPAC. About 3,000 customers use Dynamics 365 Finance in the cloud, though Microsoft doesn’t confirm specific customer numbers for its ERP products.

Dynamics 365 Business Central boasts a larger cloud customer base of about 20,000 across the Americas, EMEA and JAPAC, with annual revenue capping at $150 million. Like its larger-market counterpart, Dynamics 365 Business Central offers solid core-finance capabilities. Additional capabilities, such as CRM and HR, have some native functionality but rely on middleware integrations with partner solutions to fill gaps. For example, Dynamics 365 Business Central doesn’t have native payroll, talent management, workforce management or HR service management capabilities. As a result, adding these capabilities involves additional expense and implementation time.

NetSuite vs. Microsoft

This section examines how NetSuite and Microsoft compare on bigger-picture issues, such as go-to-market strategy, deployment options and integration/partner ecosystems. Let’s first note some commonalities — namely, both companies’ solutions are used by small, midsize and large businesses, though NetSuite’s core customer base leans more toward fast-growing organisations. And both companies offer some core ERP features across finance, HR, CRM, manufacturing and SCM, though the depth of those features varies.

Beyond those similarities, the two companies take different approaches to how they architect their solutions and how they use application partners to extend their capabilities. One of the most important — and obvious — distinctions is NetSuite’s focus on a single solution for all customers versus Microsoft’s multiproduct approach. This is an important differentiation, particularly for growing companies. Whereas NetSuite offers one ERP solution for all customers, who, as they grow, can add more capacity or features to adapt the system to new requirements, customers of Dynamics 365 Business Central could eventually outgrow their ERP system. For example, they may need support for international financial consolidation, which Dynamics 365 Business Central natively lacks and thus would necessitate a complex workaround. Ultimately, growing companies may need to implement an entirely new solution from Microsoft or another provider to accommodate their needs.

Another critical difference between the two companies’ offerings is how they deliver key ERP features to customers. NetSuite’s integrated suite of native modules combines finance, procurement, warehouse management, inventory management and more in a single solution, but the modules are sold separately. Companies can build their ERP solution by starting with only the modules they need, then purchasing additional modules later as they grow. And because all NetSuite modules are built on the same codebase, integration doesn’t require additional resources or middleware. In fact, third-party integrations are rarely required because NetSuite covers all the bases.

Meanwhile, Microsoft bundles its modules as part of its standard offering. Dynamics 365 Business Central includes, for example, finance, sales, customer service, marketing, supply chain, project management, manufacturing, CRM and warehouse management. That’s advantageous for companies that need all of those features, but those that don’t end up paying for more than they need. In addition, integration still plays a large role in Microsoft’s ERP solutions, because many of its modules were acquired from other companies and built on different codebases. They’re distinct applications with their own user interfaces and databases.

For example, Microsoft Dynamics 365 Sales, the company’s CRM solution, was built largely by Microsoft and uses a different codebase than the other modules. As a result, it requires significant and costly integration, using Microsoft’s Dataverse middleware to connect with the core ERP system. Dynamics 365 Finance’s modules for CRM and payroll are also on different codebases. In other cases, integrations are required to fill feature gaps in Microsoft solutions. For example, commissions and subscription billing aren’t native for Dynamics 365 Finance and require integration with partner solutions or third-party apps.

It’s also important to note the differences in how each company built its solutions. Microsoft’s ERP systems were built or acquired as on-premises solutions that were then re-architected for the cloud. As a result, Microsoft can offer customers more options for how they want to deploy their ERP system: in the cloud, as a hybrid solution or on premises. But because Microsoft’s solutions aren’t cloud-native, upgrades are more complex — creating integrations and customisations that can break in the process — which is why some customers delay them. As a result, they miss out on the latest features and leave themselves vulnerable to cybersecurity attacks.

NetSuite is a cloud-only solution. Its native cloud architecture means that all customers use the same version, with twice-yearly upgrades that automatically carry customisations over to the latest version.

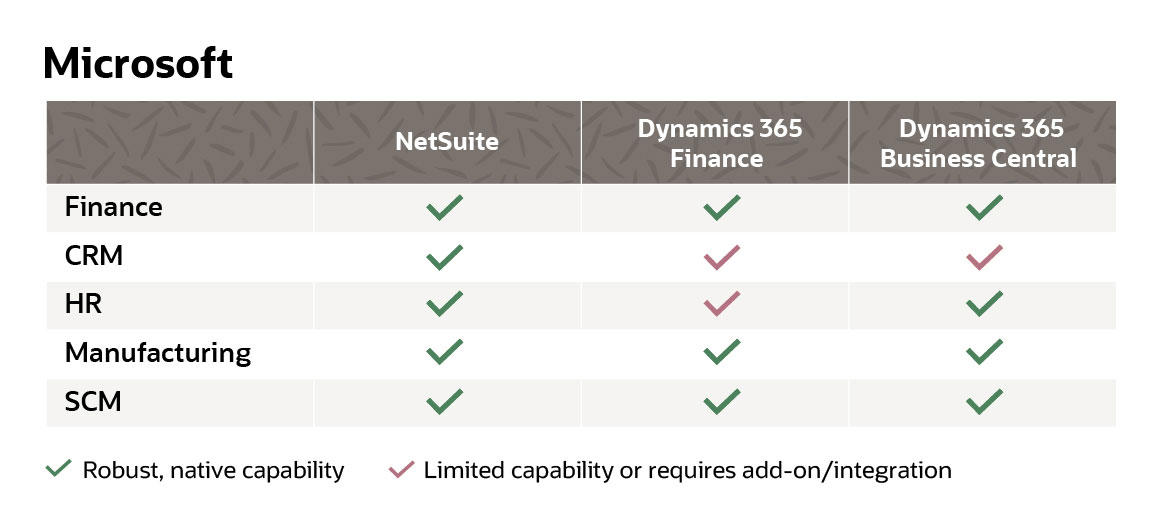

How NetSuite Features Compare to Microsoft

When it comes to specific feature comparisons, NetSuite’s and Microsoft’s ERP solutions offer similar capabilities. The question for ERP buyers is: Do they want a system with all the features baked in, or would they prefer a more integrated approach to adding functionality through additional applications? Each option has its pros and cons, as noted above.

Here’s an overview of key ERP features for NetSuite ERP, Microsoft Dynamics 365 Finance and Dynamics 365 Business Central:

Finance

NetSuite ERP and Microsoft Dynamics 365 Finance both feature strong core-financial capabilities, as well as support for newer revenue recognition(opens in a new tab) requirements, which are important for companies using subscription-based pricing. NetSuite has some additional revenue recognition capabilities, such as support for subscription billing and complex transactions involving multiple deliverables or bundled products/services.

Dynamics 365 Business Central doesn’t support the advanced revenue recognition features described above and also has more limited billing capabilities, requiring integrations for both features. It also doesn’t offer native financial consolidation, meaning that if a company has subsidiaries, each one would require a separate database that needs to be integrated using middleware — at additional cost. NetSuite natively maps local subsidiary ledger transactions to a standardised general ledger at the customer’s headquarters, so it doesn’t need further integrations.

CRM

NetSuite and Microsoft both offer CRM modules with strong features. As noted earlier, Dynamics 365 Sales was built by Microsoft, so it uses a different codebase than many of Microsoft’s other ERP modules. It also uses a different user interface and a separate database. Customers can combine data from multiple systems via middleware integrations, using partner resources. Both of the Microsoft products include some native CRM features, such as contact management, sales force automation and project management. Additional capabilities require integration with Microsoft Sales.

NetSuite’s CRM is natively integrated and uses the same unified database as all other NetSuite modules. It features core capabilities for sales force automation, customer service, marketing automation and sales reporting and analysis.

HR

HR capabilities for Dynamics 365 Finance also require integration with a separate application, which creates the same challenges described above for CRM. Dynamics 365 Business Central has a native HR module, as does NetSuite via its SuitePeople module.

Other Features

Each company’s products have strong manufacturing and supply chain capabilities, with both Microsoft products having particular strength in SCM.

Reporting and Analytics

NetSuite’s unified database provides a single set of companywide, consistent data for reporting. NetSuite’s SuiteAnalytics module allows users with no coding experience to build new reports and drill down into data to uncover additional insights. Conversely, because some Microsoft modules use different databases, some customers may experience reporting challenges that typically occur when trying to pull data from unconnected systems — unless they spend the time and money to integrate them using middleware.

Both Microsoft ERP solutions feature prebuilt reports. Integrations are required for any extended capabilities, such as customised dashboards or data visualisations. Microsoft’s Power BI data analytics tool can help extend reporting and analytics functionality, but customers should keep in mind that it is a complex solution that often requires specialised programming resources and extra cost to build customisations. NetSuite’s prebuilt, integrated modules consolidate data from multiple systems from the start, bypassing the need for any integration for companywide reporting.

Customisation

While most ERP systems require some degree of integration with other systems, the simpler it is to customise and integrate, the more powerful — and less costly — the ERP system becomes. NetSuite uses no-code customisation solutions to allow customers to create custom fields, reports and buttons. More complex customisation can be achieved using SuiteCloud, a Java-based customisation and integration platform.

Microsoft customisations are more complex. Dynamics 365 Finance, for example, requires knowledge of additional specific frameworks and languages, such as C# and X++, which, in turn, often necessitates more expensive third-party resources. Dynamics 365 Business Central customisations are simpler, though they require specific Microsoft Visual Studio Editor resources.

Sage Intacct Overview

Intacct was founded in 1999 as a cloud-based financial management and accounting software provider for lower–mid-market businesses. It continued refining its core financial product, receiving several rounds of venture funding, until 2017, when it was acquired by The Sage Group for $850 million. The Sage Group, which primarily operated in the U.K. and offered a number of on-premises accounting solutions, viewed Intacct as a means of expanding into the U.S. market and establishing a cloud-based solution.

Following the acquisition, Intacct was rebranded as Sage Intacct, part of The Sage Group, and has continued to focus on its core financial management product. The company has also created partnerships to allow customers to integrate with other software providers and add broader ERP capabilities, such as HR and CRM, to its primary product. Sage Intacct primarily serves a U.S.-centric base of lower–mid-market businesses, with approximately 14,000 customers worldwide. It offers multiple ERP products. Sage Intacct, which is reviewed here, serves midsize businesses with a fully cloud-based set of native financial modules, as well as additional HR capabilities. The company also offers Sage x3, which targets companies with more complex manufacturing processes, as well as multiple on-premises and cloud-based ERP solutions targeting smaller businesses and specific industries, such as construction, hospitality and wholesale distribution.

NetSuite vs. Sage Intacct

Comparisons between NetSuite and Sage Intacct should begin by noting the difference in how each company approaches ERP. Sage Intacct is, first and foremost, a financial management and accounting solution that provides additional capabilities, such as HR, CRM, manufacturing, SCM and ecommerce, via integrations. Like Microsoft, these integrations require additional work and create separate databases. Sage Intacct’s marketplace of partner solutions features 50 complementary applications on its platform and another 200 integration partners whose applications can be connected via the company’s Web Services tool. Those solutions often come with additional fees and resource requirements, which can increase Sage Intacct’s total cost of ownership (TCO). These limitations ultimately make Sage Intacct best suited to companies upgrading from an entry-level accounting system.

As noted in the NetSuite Overview section, NetSuite’s all-in-one ERP approach natively integrates a suite of ERP modules into a single product, so integrations are usually unnecessary and data is consolidated into a single database. NetSuite’s SuiteApp.com marketplace offers 600-plus add-on applications built for the NetSuite platform.

The two companies also differ in the way they approach implementation and support. NetSuite’s SuiteSuccess methodology aggregates industry-specific best practises to provide implementation in as few as 100 days — often far less time than is usual for Sage Intacct. Customers can use NetSuite’s professional services organisation or a NetSuite partner for implementation. Sage Intacct offers a small professional-services team, and most implementations rely on partners.

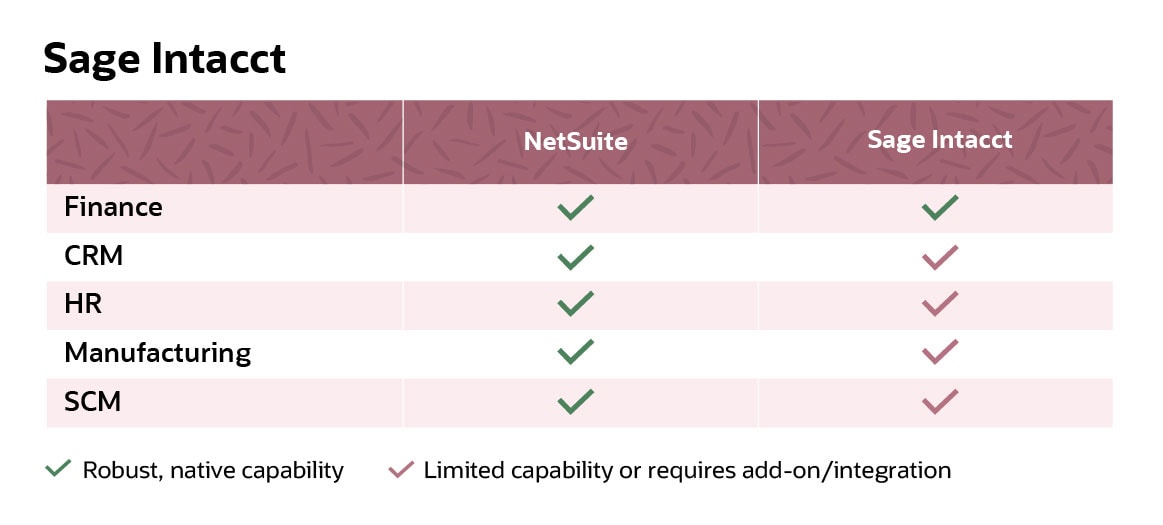

How NetSuite Features Compare to Sage Intacct

When it comes to native modules, NetSuite and Sage Intacct primarily have a financial management module in common, though the latter offers limited capabilities in a few other areas. Here’s a look at how the two vendors’ ERP features stack up:

Finance

NetSuite and Sage Intacct both offer robust financial modules, but potential buyers should consider a few key differences. For example, for the many companies shifting to subscription-based models, bundled products and services, and project-based revenue recognition, advanced revenue recognition has become more important. NetSuite handles complex revenue recognition scenarios based on accounting standards, such as ASC 606 and IFRS 15, enabling businesses to automate complex processes, track revenue, ensure compliance with accounting standards and streamline financial reporting. Sage Intacct’s revenue recognition capabilities require the purchase of an additional module.

Global customers should also note that Sage Intacct has limited global capabilities and primarily serves English-speaking countries. That means that they must purchase additional modules to accommodate some features, such as global consolidation and VAT tax capabilities. Multisubsidiary consolidation with Sage Intacct calls for an additional separate consolidation module, and adding the ability to create intercompany reports requires subscriptions to Sage Intacct’s customisation services, platform services or custom report writer.

NetSuite ERP provides multi-entity consolidation natively, with real-time visibility into intercompany transactions, financial reporting and automated eliminations all included. The NetSuite OneWorld module supports 27 languages, more than 190 currencies, transactions in more than 90 bank formats, and tax and reporting standards for more than 100 countries.

CRM

Sage Intacct lacks a native CRM offering, instead relying on an integration with Salesforce.com. NetSuite has its own native CRM module that includes sales force automation, customer service management and marketing automation, as well as a connector to Salesforce.com, whose records sit inside NetSuite and are fully searchable and reportable.

HR

Sage Intacct has limited native HR capabilities through its Sage People app, which is a separate software package, as is its payroll offering powered by ADP. Each application requires somewhat significant integrations and uses a separate data model, making it difficult to see information on payroll and operational productivity side-by-side, for example. NetSuite’s native HR module, SuitePeople, covers payroll, employee recognition, and performance and workforce management.

Production and Supply Chain

NetSuite’s manufacturing module includes product data management, work order management, demand/supply planning and forecasting, quality management, execution systems, and work in process (WIP) and routing. Sage Intacct has no native module for manufacturing, again relying on integrations to fill gaps. Sage Intacct supports some supply chain functionality, including inventory management, though the majority of its SCM capabilities require integrations. NetSuite’s supply chain module includes order and inventory management, procurement, planning and execution, warehouse management and demand planning.

Ecommerce

Sage Intacct also relies on integrations for its limited ecommerce support, while NetSuite offers SuiteCommerce, its native commerce module. SuiteCommerce supports B2B and B2C omnichannel experiences, as well as content management and embedded promotions tools.

Reporting and Analytics

NetSuite and Sage Intacct both offer business intelligence, analytics and reporting capabilities. NetSuite offers a wider range of prebuilt financial and operational reports (200, compared to Sage Intacct’s 60), customisable dashboards and data visualisation capabilities.

The two companies also take distinct approaches to data modelling, with implications for not only the speed of reporting but its limitations, as well. Whereas NetSuite uses a single, shared database to provide real-time access to companywide data, Sage Intacct uses separate data tables to house information on different parts of the business in subledgers. As a result, Sage Intacct’s report writer carries an additional charge for customers seeking to combine operational and financial data. Granted, Sage Intacct’s subledger approach has the advantage of ensuring the accuracy of financial data, but it relies on batch processing, which doesn’t run in real time and can slow down reporting.

Customisation

NetSuite and Sage Intacct both offer tools that use industry-standard JavaScript to help customers and partners develop their own customisations, functionality and applications. They also provide integrated development environments (IDEs) and application programming interfaces (APIs) to connect other applications to their platforms. NetSuite’s SuiteCloud development platform allows businesses to tailor their ERP systems to their specific needs. Sage Intacct also offers some customisation and integrations using open, XML-based APIs and software development kits (SDKs), but not to the same extent as NetSuite.

SAP Overview

SAP was founded in Mannheim, Germany, in 1972; it launched its first product, R/1, an accounting system running on IBM servers, the following year. Two subsequent versions, R/2 and R/3, were launched in 1979 and 1993, respectively. R/2 was a mainframe-based solution that later added support for manufacturing processes, supply chain logistics and human resources. R/3 was a client-server–based solution that evolved into SAP Enterprise Central Component (ECC), the company’s first ERP product, in 2004. SAP ECC is still widely used today, though the company will no longer support it after 2027.

Today, SAP offers three ERP products, targeting companies of all sizes:

- SAP Business One: An on-premises ERP solution that recently transitioned to a hosted-cloud offering for small and midsize businesses (SMBs), often fewer than 50 users.

- SAP Business ByDesign: SAP’s first cloud-based ERP solution launched in 2007, though it was subsequently pulled from the market for further retooling and rereleased in 2008, focusing on the manufacturing, wholesale distribution and professional services industries. It targets SMBs of up to roughly 1,500 users and offers support for finance, CRM, procurement, project management and SCM.

- SAP S/4HANA: SAP’s flagship ERP product was launched in 2015 for on-premises and cloud environments. Because it’s built on SAP’s in-memory database technology, it enables real-time processing of large amounts of data, which makes it well suited for larger enterprises. It features advanced analytics, artificial intelligence (AI), machine learning (ML), automation and integration capabilities. Current SAP ECC customers will need to move to S/4HANA by 2027.

SAP’s three ERP products have approximately 80,000 combined customers in over 180 countries. Its customer base is almost evenly split between the Americas and EMEA, with another, smaller presence in APAC.

NetSuite vs. SAP

NetSuite’s and SAP’s ERP solutions have quite a bit in common. Both providers target customers of all sizes and boast a wide range of modules across core ERP functions. But a peek under the hood reveals two companies with noticeably different approaches to ERP in terms of product portfolios, deployment options and depth of features.

As mentioned earlier, NetSuite has only one ERP product. Because it was created as a 100% cloud-based solution, every customer uses the same system, and customers benefit from streamlined implementation processes and smooth upgrades and updates. SAP has had multiple on-premises, cloud and hybrid ERP solutions throughout the years, sometimes targeting the same audiences and often causing confusion among customers. As with Microsoft, SAP’s multiproduct strategy can create challenges as companies grow. For example, SAP’s Business One is ideally suited for companies with fewer than 350 users; any more than that and performance issues can arise. To address that problem, growing customers must move to an entirely new system — Business ByDesign, S/4HANA or a system from a new provider.

NetSuite’s integrated suite architecture also differs from SAP’s approach to delivering many of its features. Due to feature gaps (described later), SAP customers are more likely to require integrations with other products in the company’s portfolio (or from partners) to provide the same level of functionality as NetSuite. Those integrations can create a web of solutions that use different codebases and data structures, as noted with other providers earlier.

Consultants are often needed to connect those systems using middleware, and they’ll also have to retest those integrations with each system upgrade to ensure that they don’t break. SAP’s partner apps and extensions can simplify integrations. Each product’s ecosystem varies in size. S/4HANA has 400-plus apps and extensions available, with most intended for on-premises deployments (100-plus for S/4HANA Cloud, 20 of which are SAP-certified). ByDesign has slightly more than 100 partners (three certified). Business One has fewer than 40 (16 certified). As noted earlier, NetSuite’s unified platform and extensive ecosystem of 600-plus partner applications, extensions and add-ons reduce the need for integrations because so many capabilities are built on — or for — the platform.

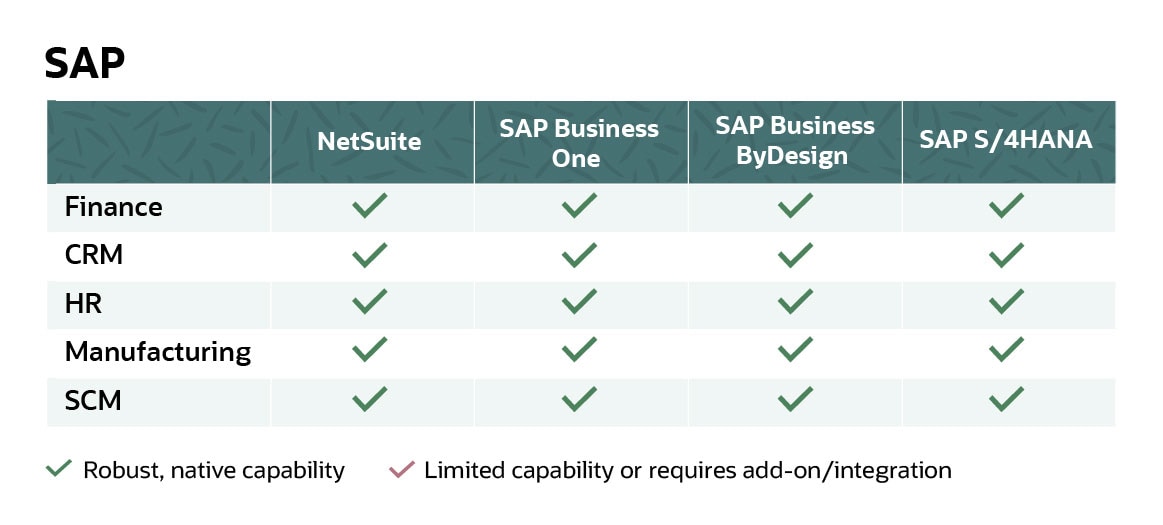

How NetSuite Features Compare to SAP

Similar to many of the other ERP providers in this article, SAP relies more on integrations, extensions and add-ons to provide comprehensive features in its offerings. Each of its products has a different mix of native capabilities, however. Here’s how SAP’s overall capabilities compare to NetSuite:

Finance

Like NetSuite’s ERP solutions, SAP products offer a wide range of financial management tools, including accounting, budgeting, forecasting and financial reporting. Financial consolidation capabilities represent the biggest difference between the two ERP solutions. NetSuite’s OneWorld module offers native financial consolidation and intercompany capabilities. But S/4HANA, for example, uses group reporting for financial consolidation, which is less mature and may require additional products and licences to work effectively. Both Business One and ByDesign require integrations with SAP or third-party apps for financial consolidation capabilities that are comparable to NetSuite’s.

CRM

NetSuite, S/4HANA and ByDesign all offer similar core CRM functionality, with automation tools for sales force, customer service, and marketing campaigns and emails. Business One has more limited CRM features, specifically regarding sales force and marketing automation.

Manufacturing and SCM

Each company’s ERP solution provides a strong set of manufacturing and SCM capabilities. SAP’s offerings have slightly stronger manufacturing capabilities. Business One, for example, offers deep core functionality for demand planning, engineer-to-order (ETO) and material-requirements planning (MRP). S/4HANA is particularly well suited to companies with complex processes, providing the ability to support lean control, continuous improvement and just-in-time replenishment.

HR

For the most part, each company’s solutions handle key HR functions, such as employee management, benefits administration and payroll processing. ByDesign’s payroll process is slightly more limited, compared to NetSuite, which has its dedicated SuitePeople module for HR capabilities. SAP customers wanting more HR features would need an additional licence for SuccessFactors, the cloud-based HR systems provider SAP acquired in 2012, though the integration may require middleware and additional resources to implement and maintain.

Ecommerce

SAP doesn’t have native ecommerce modules for any of its ERP solutions, but it does offer integrations to fill the gap, most notably with its SAP Hybris/Commerce Cloud and C/4HANA solutions. The former is an add-on and better suited to enterprises than to SMBs. NetSuite offers a native ecommerce module, SuiteCommerce, with B2B and B2C functionality for drag-and-drop editing, responsive site design and a built-in content delivery network (CDN).

Reporting and Analytics

SAP’s reporting and analytics capabilities vary by product. For most reporting capabilities, including customised reporting, Business One requires an integration with SAP’s Crystal Reports software. Crystal Reports was built in the 1990s for fairly technical users and lacks some critical capabilities, such as drill down/drill through for custom reporting. For analytics, customers can also use SAP Analytics Cloud, a separate product requiring an additional licence. Customisations for both require partner resources.

ByDesign and NetSuite provide similar reporting features, with support for real-time data analysis, visualisation tools and drill down/drill through functionality for custom reports. Because NetSuite uses a consistent data model and database for all of its information, customers can drill down and drill through customised reports and dashboards, from summary-level data to detailed levels. NetSuite SuiteAnalytics also enables end users to self-serve real-time analytics across all areas of the business, eliminating the need for developers, separate reporting tools or data warehouses.

S/4HANA also offers strong analytics capabilities, with intuitive dashboards and emphasis on AI. With a conversational interface and digital assistants, users can review real-time company data and quickly make informed decisions.

Customisation

Like Microsoft, SAP bundles its ERP modules as a standard offering. For example, SAP Business One customers can only opt out of its CRM module. Customers either purchase everything or find another solution. NetSuite customers can opt in or out of any module, building gradually as they grow.

Customisation also involves adapting ERP processes and workflows to each company’s unique processes and policies. SAP’s solutions can be rigid in that regard. Customising Business One, for example, requires Microsoft Visual Studio, a separate tool that often entails external resources for any changes. In addition, ByDesign uses best-practise processes that are difficult to change, and it has no engine to create custom workflows. S/4HANA Cloud is also a highly standardised product offering little in the way of customisation, which some businesses may prefer because it forces the organisation to adapt to standard processes. Notably, S/4HANA uses machine learning to capture real-time insights and surface patterns that can then be used to automate and optimise business processes on the fly.

NetSuite supports point-and-click, standards-based customisation and rapid configuration of processes, interfaces, roles and reports. NetSuite’s SuiteFlow module uses a “clicks not code” framework, so customers can configure workflows themselves.

Deltek Overview

Founded in 1983 by accountant Donald deLaski and his son Ken, Deltek has had a winding ownership journey. After an IPO in 1996, the deLaskis took the company private in 2002, following a sharp decline in stock price. In 2005, investment firm New Mountain Capital acquired a 75% stake in the company, which once again went public in 2007. In 2012, however, Deltek was taken private again, when it was purchased by private equity firm Thoma Bravo for $1.1 billion. In 2016, Roper Technologies purchased Deltek for $2.8 billion.

Through it all, Deltek has had a specific mission: to serve a targeted audience in government contracting, professional services, architecture and engineering, and construction. Deltek offers six ERP solutions with a fundamental set of primarily finance and project management capabilities. It surrounds these platforms with a wide range of modules for information management, business development, project portfolio management, HR and manufacturing.

Much of Deltek’s ERP portfolio was built through acquisitions (ComputerEase, Maconomy and Workbook), and each of its six solutions can be deployed on premises or in the cloud. The company is in the midst of transitioning customers from its flagship ERP product, Vision, to an updated offering built with Vision as its foundation, though the rollout has been choppy. Initially, the updated offering was billed as a true-cloud ERP system called Deltek for Professional Services (DPS). It launched in 2017 but was renamed Vantagepoint in 2018, with both on-premises and cloud deployment options. Deltek’s ERP portfolio consists of:

- Ajera: For architectural and engineering firms with roughly 25 users or fewer

- ComputerEase: For the construction industry

- Vantagepoint: For larger architecture and engineering firms, as well as consultants

- Costpoint: For government contractors

- Maconomy: For professional services firms

- Workbook: For agencies

Deltek has approximately 30,000 total global customers, with many located in English-speaking countries. Its customers range from very small businesses with fewer than 25 users (Ajera) to large enterprises with more than 10,000 (Maconomy).

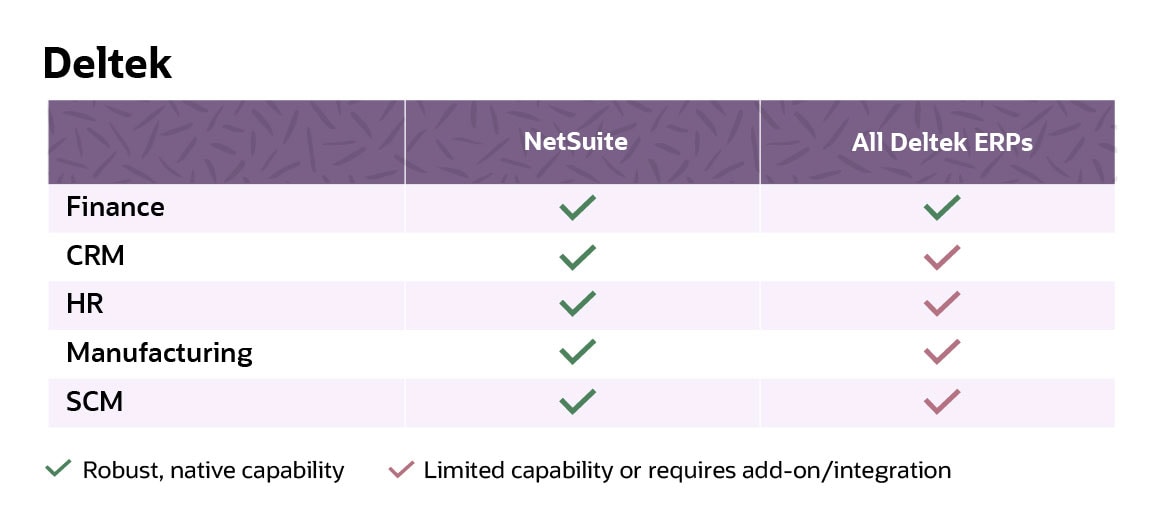

NetSuite vs. Deltek

Because Deltek’s ERP solutions cater to service-oriented businesses, its products have a strong focus on accounting and project management. Deltek’s solutions also have some manufacturing, HR and CRM capabilities, but they’re separate modules from its core ERP systems, so customers must use integrations to connect them. To help, in late 2022 Deltek launched Unionpoint, a no-code/low-code integration-platform-as-a-service (IPaaS) that makes it easier to connect Deltek modules and integrate with third-party apps. Since Unionpoint’s launch, Deltek has released connectors for two of its products, Vantagepoint and Deltek Talent Management, which make it easier to integrate them with other Deltek modules and third-party apps. More connectors are expected soon. Deltek partnered with Workato to build Unionpoint.

Like those of other ERP players, Deltek’s integrations mean data isn’t stored in a single database, limiting visibility into real-time, consistent data for decision-making. By contrast, NetSuite’s entire solution is built on the same code, with a single database, so users can consolidate data from across the entire organisation for greater insights. It also means integrations are seamless among all NetSuite modules.

Deltek’s application partner programme provides some help with extending capabilities, offering roughly 50 integrations built for its platforms that customers can use to extend functionality. NetSuite’s SuiteApps.com marketplace features more than 600 partner applications built for the NetSuite platform.

How NetSuite Features Compare to Deltek

As noted above, Deltek’s primary customers are service-based organisations, so the company’s manufacturing and SCM capabilities, understandably, don’t go as far as NetSuite’s. On the other hand, its project management features are extensive. Here’s how the two companies’ ERP solutions stack up:

Finance

Every Deltek ERP system offers some degree of financial capability, but it varies by product. For example, Maconomy has solid financial capabilities, including multi-entity consolidation, but most finance operations for Workbook need an add-on. Vantagepoint has solid accounting features, but its financial management capabilities are limited, compared with NetSuite’s. For example, Vantagepoint lacks tax management options. Meanwhile, NetSuite’s financial management module, NetSuite OneWorld, handles everything from accounting to multi-entity consolidation, subscription billing and advanced revenue recognition. NetSuite OneWorld also manages multiple subsidiaries, business units and legal entities, domestic or internationally, from a single solution.

CRM

Deltek ERP solutions offer CRM functionality, but largely through integration with one of Deltek’s two CRM offerings. The company’s main CRM module, Vantagepoint CRM, allows customers to gather information about clients to streamline processes, activities and interactions. Its other module, Vantagepoint CRM Plus, provides additional support for marketing campaigns, activities and lead qualification. As for NetSuite, its native CRM module manages sales force automation, marketing automation, customer service management, partner relationship management, and reporting. It also offers native integration with other NetSuite modules, such as ecommerce, to pull data across both modules into a single system for better automation and reporting.

HR

Deltek and NetSuite take different approaches to their HR solutions. NetSuite offers an all-in-one HR module, SuitePeople, while Deltek offers several HR modules with different characteristics, rather than one native solution. Deltek’s central HR module allows companies to store and manage employee information. For other tasks, Costpoint and Vantagepoint customers can integrate with Deltek’s Talent Management module, which adds recruitment, training, performance and development, and compensation. As of 2022, integrating Vantagepoint with Talent Management became simpler, thanks to Deltek’s Unionpoint IPaaS solution. For customers using other Deltek ERP solutions, similar capabilities are available via integration with separate modules for acquisition, compensation, learning and performance management.

NetSuite SuitePeople offers similar functions in one solution, along with robust analytics and global features. It also natively connects HR and payroll data with financial, project planning and budgeting, and procurement processes — in one database.

Project Management

NetSuite and Deltek both offer substantial professional services automation (PSA) tools. NetSuite’s SuiteProjects module offers contextual project collaboration, resource management, project management, project accounting, business intelligence and flexible permissions. NetSuite’s native integrations with other modules, such as finance and accounting, pull detailed data from every module into a single, real-time database for greater insights. NetSuite’s OpenAir professional services automation tool also supports large services organisations focused on delivering complex projects.

Because Deltek targets professional services companies, its PSA tools offer a few more specialised capabilities than NetSuite. For example, Deltek’s ArchiSnapper field app for architecture and engineering firms features paperless inspections, automated field reports and simplified punch lists.

Manufacturing and SCM

While NetSuite and Deltek both offer manufacturing and SCM capabilities, Deltek’s focus on professional services organisations means that its capabilities in these areas are limited. Deltek Costpoint is the company’s principal manufacturing ERP solution, but it largely focuses on project management for its customers in government aerospace contracting. Additional features require integration. That said, Deltek’s 2022 acquisition of TIP Technologies deepened Deltek’s manufacturing capabilities. Dubbed Deltek + TIP, the new module is a quality management system (QMS) that supports compliance, process automation and supply chain quality management. TIP Technologies, which was already a Deltek independent software vendor, also offers a seamlessly integrated module for shop-floor manufacturing execution.

NetSuite’s manufacturing and SCM capabilities are considerable. NetSuite manufacturing features include product data management, work order management, demand planning and forecasting, quality management, manufacturing execution, and WIP and routing. NetSuite SCM covers order management, inventory management, procurement, global planning and execution, and warehouse management.

Reporting and Analytics

NetSuite’s unified database offers several key reporting benefits, compared to ERP solutions that use integrated applications with their own data models and databases, as some Deltek products do. NetSuite’s consistent data model and unified database let customers drill down and drill through customised reports and dashboards, from the summary level to detailed levels. And its SuiteAnalytics lets end users self-serve real-time analytics across all areas of the business, eliminating the need for developers, separate reporting tools and data warehouses.

Some Deltek products, such as Costpoint, have no native ability to configure dashboards, forms, saved searches, reports or workflows. Prebuilt reports are available, but customised reporting means adding tools or partner assistance. Vantagepoint has a business intelligence module that lets users dynamically create dashboards, but users must export data to Excel for dynamic manipulation. Vantagepoint also lacks a detailed built-in report writer.

Customisation

Deltek’s history of building some products and acquiring others means that its products frequently require customisation. For example, Maconomy customers often heavily customise the solution, which involves incorporating Deltek professional services at additional cost. NetSuite offers a highly customisable architecture, with its SuiteFlow “clicks not code” framework and point-and-click tools for standardised customisations. In addition to SuiteFlow, during implementation, NetSuite’s SuiteSuccess methodology includes best practises for implementation, including customisation, acquired across 25 years and focused on a single, cloud-based ERP solution. NetSuite’s expansive Customer Success and Support Services teams also provide solution guidance and ongoing configuration assistance.

Epicor Overview

Epicor is another ERP provider with a long, complex history. Ownership of the company has changed hands four times in 12 years. The Epicor brand launched in 1999, following the merger of two accounting software companies: DataWorks and Platinum Software. In 2011, Apax Partners purchased Epicor for roughly $1 billion and merged it with another recent acquisition, Activant, a supplier of accounting software for automotive, hardware and lumber, and wholesale distribution companies. The merged company kept the Epicor name. Private equity firm KKR purchased Epicor for $3.3 billion in 2016 and sold it for $4.7 billion in 2020 to Clayton, Dubilier & Rice, another private equity firm.

Epicor offers 11 ERP products, serving 21,000 mostly midsize customers in 120 countries, although 75% of its customers are in North America. Its ERP solutions target the manufacturing, building supply, distribution, automotive and retail industries. Epicor is known for its strong, out-of-the-box expertise in SCM, production management, inventory management, and warehouse and fulfilment. Many of Epicor’s ERP systems appeal to highly specific markets. For example, Epicor Eagle and Propello are retail management systems that can be augmented with additional components for particular features, such as finance.

This comparison will focus on two of Epicor’s broader offerings:

- Epicor Kinetic: The company’s flagship ERP for manufacturing, launched in 2021, offers a multitenant cloud-based upgrade of its previous Epicor ERP, a single-tenant hosted solution that many of the company’s manufacturing customers still use.

- Epicor Prophet 21: This cloud-based ERP, hosted on Microsoft Azure, targets wholesale distributors.

Despite its many changes in ownership, Epicor has maintained a steady pace of acquisitions, adding 12 companies during that same 12-year span of time. Most of the acquired companies provide cloud-based modules that boost Epicor’s existing product portfolio. Recent examples include DSPanel, which provides cloud-based financial planning and analysis software, and eFlex, which offers cloud-based manufacturing execution systems.

These acquisitions have been important for Epicor, which came late to the cloud game. The vendor began re-architecting its portfolio in 2015, and its first cloud offerings arrived in 2018. Since then, it has standardised its portfolio with multitenant cloud offerings through its partnership with Microsoft Azure.

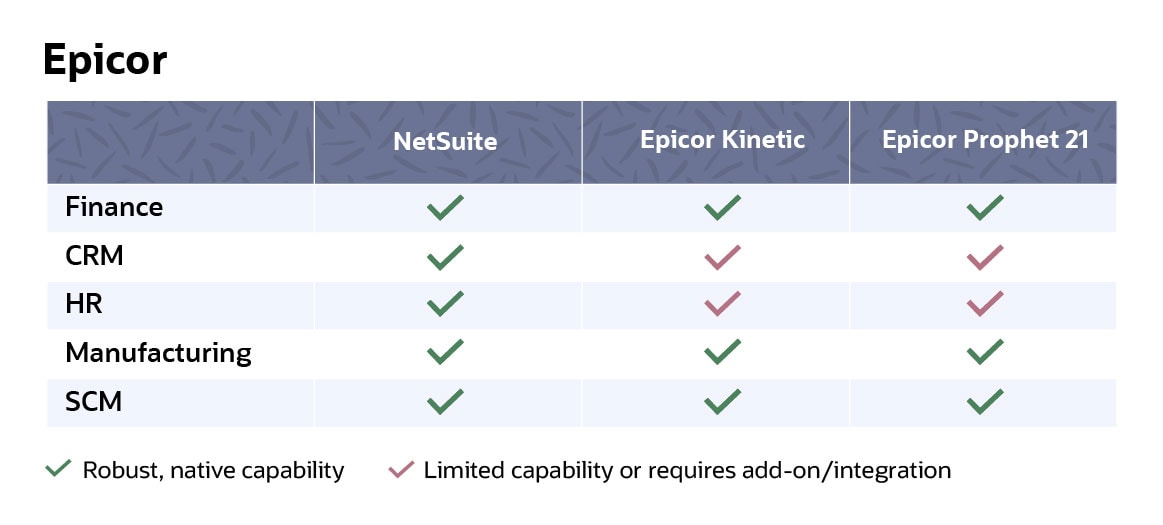

NetSuite vs. Epicor

Like Sage Intacct and Deltek, Epicor is more of a specialist ERP systems provider when compared to NetSuite; it focuses on a far narrower set of manufacturing customers and offers a smaller set of core capabilities.

Epicor provides basic financial management functionality in all of its solutions, but its bread and butter lies in its manufacturing and SCM focus (especially with its flagship Kinetic ERP system). CRM, HR and ecommerce capabilities can be added to Epicor’s core ERP products, but they require integration with other systems, at additional cost. In addition, each Epicor ERP solution constitutes a separate platform, so if a customer does business in two Epicor verticals, it needs to implement two ERP solutions.

Integrations with third-party or partner systems also introduce new codebases and databases into Epicor’s solutions, so data isn’t stored in one location but, rather, in silos. NetSuite’s comprehensive solution features 13 natively integrated modules, with no further integrations required. For customers that want to integrate with third-party applications, NetSuite’s partner ecosystem is significantly larger than Epicor’s. NetSuite has more than 600 partners with solutions built for NetSuite, while Epicor has 25. NetSuite’s integrated approach also creates a single database incorporating clean, consistent data that can be used to build richer insights derived from information drawn from across the entire organisation.

The two companies also offer divergent deployment options. NetSuite is 100% cloud-based, while Epicor offers three deployment choices: cloud, hosted and on premises. Its cloud solutions, however, are re-architected on-premises solutions, which means that upgrades can sometimes be challenging and run the risk of broken customisations. As a result, some customers forgo them and become version-locked, reducing their access to the latest innovations and potentially exposing themselves to security breaches.

How NetSuite Features Compare to Epicor

As with Deltek, Epicor’s narrow, vertical industry focus means that it has strengths in particular areas, such as manufacturing and SCM capabilities. Across other modules, however, Epicor relies on integrations with its acquired point solutions or those it has cultivated with a limited set of independent software vendor partners.

Finance

Financial management is a core feature of almost every ERP system, and so it is with NetSuite and Epicor Kinetic and Prophet 21. Both NetSuite and Epicor offer strong financial functionality, including revenue recognition and global capabilities. Epicor Kinetic offers particularly strong risk management proficiency, despite requiring add-ons or third-party integrations for customisable reporting, planning and budgeting. Epicor’s March 2023 acquisition of cloud-based financial planning and analysis provider DSPanel adds this functionality when integrated. However, Epicor’s products lack native multi-entity consolidation, a core feature for NetSuite. Each Epicor entity uses a separate general ledger that needs to be consolidated manually or on a triggered batch sync, which necessitates another module.

HR

Both companies offer HR capabilities. Similar to many other Epicor features, HR and payroll are separate systems that have to be integrated. As a result, there’s no unified database serving the two functions. NetSuite’s SuitePeople module offers a few additional features that Epicor doesn’t. NetSuite includes workforce reporting and analytics, for example, functions that require an add-on or third-party app for Epicor.

CRM

While both companies have CRM modules, NetSuite’s offers more features than Epicor’s. Like many of its other modules, Epicor’s CRM uses a separate database, so customers don’t get the benefits of real-time reporting that, for example, allows customer and financial data to be combined. NetSuite also provides sales force automation features; Epicor doesn’t.

Manufacturing and SCM

With its long history in the manufacturing and distribution industries, Epicor has thorough offerings in manufacturing and SCM. NetSuite’s manufacturing capabilities are also considerable, as noted above, but, ultimately, Epicor enjoys a few more native features than NetSuite. For example, Epicor’s 2022 acquisition of eFlex Systems, a provider of cloud-based MES technologies, enables manufacturers to manage and visualise global operations in real time, connecting devices, sensors and machines with people to help operators build the right part, with the right tool, at the right setting, in a safe and repeatable way.

Epicor also performs strongly in SCM, particularly for production management, inventory management, and warehouse and fulfilment. It also offers products highly tailored for specific industries, such as automotive and electronics manufacturing. NetSuite offers some of these capabilities but customers may require additional modules and/or partner applications.

Reporting and Analytics

Epicor’s native reporting and analytics capabilities aren’t as robust as NetSuite’s. For example, Epicor’s analytics module uses a separate database, so customers can’t create real-time reports. Nor does Epicor offer preloaded dashboards. Integrations with third-party apps, such as SAP’s Crystal Reports and Microsoft SQL Server Reporting Services (SSRS), can offer better report customisation, but between licence fees and integration efforts, costs can add up. In addition, both report-creation tools require technical expertise to create customised reports, leading some customers to hire dedicated report writers or use Epicor’s professional services team.

Why Choose NetSuite?

NetSuite’s approach to ERP emphasises scalability, seamless integrations and simplified customisations to combine the power of feature-rich native modules with the flexibility to adapt NetSuite ERP to meet specific business requirements. By offering each of its modules individually, NetSuite allows customers to start small — with a single finance module, for example — and then add additional modules later, as needed. Each module is prebuilt for integration, so no additional resources or costs are necessary. The NetSuite SuiteCloud customisation tool also helps organisations adapt NetSuite to their unique business models and IT ecosystems, including integrations with third-party applications. In addition, NetSuite has a marketplace of more than 600 prebuilt integrations with partner solutions that can easily extend capabilities across the entire platform.

As NetSuite celebrates its 25th anniversary, it remains committed to delivering the most powerful, but easy-to-use ERP in the market, supported by an extensive customer success team and implementation methodologies derived from tens of thousands of implementations worldwide.

Comparing ERP system providers rarely involves an apples-to-apples comparison. Each solution has its own strengths and weaknesses, and what’s seen as a strength by one ERP buyer may be a weakness for another. Understanding each vendor’s history, however, as well as the differences in how they define and deliver their products, can help determine which solution best fits a company’s distinct needs.

ERP Comparison FAQs

How do you compare two ERP systems?

When comparing enterprise resource planning (ERP) systems, companies should start by understanding and prioritising their own needs, so they know which capabilities are critical for their success. Most comparisons will focus on key areas, such as deployment options (cloud, on premises, hybrid) and key ERP features (finance, human resources, customer relationship management, manufacturing and supply chain management, reporting and analytics, customisation, integration).

What are the 3 leading ERP systems?

In terms of global popularity, the three leading providers of enterprise resource planning (ERP) systems are:

- Oracle, which has two ERP brands: NetSuite ERP for small, midsize and large businesses, and Oracle Fusion ERP for larger enterprises. Oracle ERP customers vary between on-premises and cloud deployments, while NetSuite customers are all cloud-based.

- SAP, which offers ERP solutions for companies of various sizes: SAP Business One for smaller companies, SAP Business ByDesign for small and midsize companies, and SAP S/4HANA for larger enterprises. Many SAP customers prefer on-premises deployments.

- Microsoft, which offers Dynamics 365 Business Central, for small to midsize customers with deployment in the cloud, and Dynamics 365 Finance, for larger companies and deployed both on premises and in the cloud.

What is the leading ERP?

Because companies don’t often provide sales reports for individual enterprise resource planning (ERP) products, it’s difficult to pinpoint the leading ERP provider by revenue or market share. However, because of its deep penetration in small, midsize and large organisations, Oracle, which owns two popular brands with Oracle Fusion ERP and NetSuite, has considerable global market share, particularly in the area of cloud-based deployments.

Which ERP module is best?

Choosing the best enterprise resource planning (ERP) module is like choosing your favourite child. Each module has its own unique set of qualities, and it’s difficult to rate one above the other. Financial management is often considered the central ERP module, however, because finances are the lifeblood of a company, and many other ERP modules (such as CRM and manufacturing) feed data back into financial systems.