Most businesses seek growth, which they often pursue by investing significant resources in entering new markets, enlarging their customer base or introducing new products and services. Alternatively, business leaders can also grow by acquiring, merging with or otherwise aligning with another company. Horizontal integration is one such approach, in which one company combines with another that operates at the same level in the value chain in a particular industry. For example, a big-box electronics retailer may embark on a horizontal integration by acquiring a complementary chain of stores selling similar products, or an auto manufacturer might merge with another carmaker. While horizontal integration comes with its share of challenges, the strategy can offer a number of benefits for businesses when the integration is carried out successfully.

What Is Horizontal Integration?

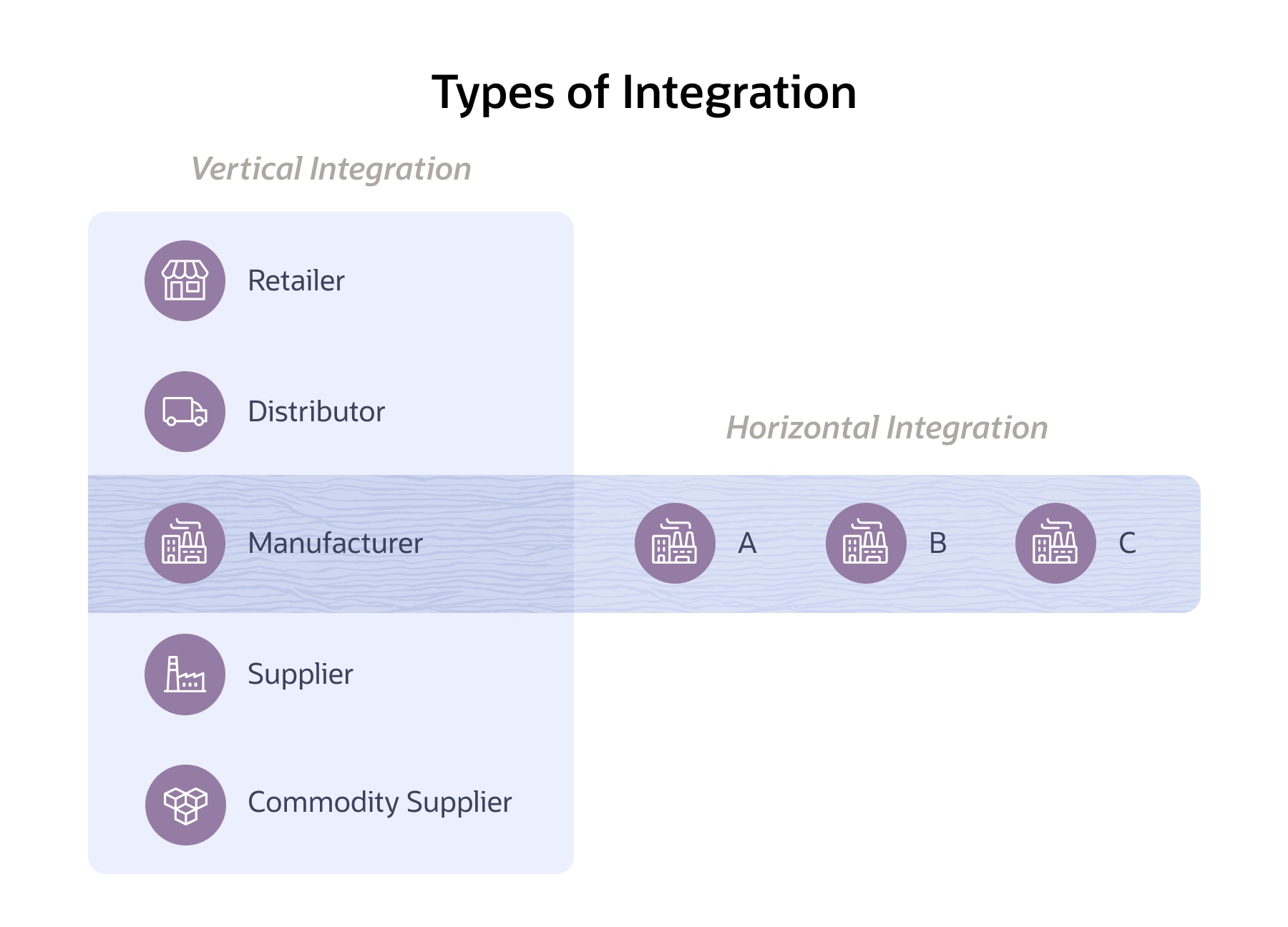

Horizontal integration is a business-growth strategy that companies pursue to expand their footprint in the marketplace. In a horizontal integration, a business combines forces with another company that offers similar products or services. This type of integration differs from vertical integration, in which a company expands either upstream or downstream by acquiring firms in an earlier or later phase of the value chain, such as a manufacturer taking over a distributor or merging with a retailer. In contrast, a horizontal integration involves a company acquiring or merging with another company in the same industry that operates at the same point in the value chain. The combination of the two businesses typically results in a single company that sells more products and/or services than either organisation could individually and thus has a more dominant role in the marketplace.

Key Takeaways

- Horizontal integration occurs when a company acquires or merges with another company in the same industry that is operating at the same level in the value chain.

- Companies may pursue horizontal integration to grow their existing business or prevent a competitor from gaining market share.

- Potential benefits of horizontal integration include a stronger competitive position, increased revenues, greater economies of scale, access to new markets and customers, and diversification of products and services.

- Executing a successful horizontal integration can be difficult. In some cases, it increases organisational complexity, creates internal strife as teams adjust to new ways of doing business and leads to potential legal issues and regulatory scrutiny, particularly if the resulting industry consolidation risks creating a monopoly.

Horizontal Integration Explained

Horizontal integration as a growth strategy can enable a company to edge out competitors and enhance their position in the marketplace, achieve greater economies of scale, expand into new geographic markets, reach additional customer segments, or acquire desirable product lines, to name a few reasons. Businesses may engage in horizontal integration for a variety of reasons: to enter into new geographic markets, reach additional customer segments, expand or diversify their product or service offerings, or gain economies of scale.

At the heart of the horizontal integration approach is often a desire to neutralie competition, whether from direct rivals, new entrants in the industry, or companies offering alternative or complementary products and services. The end goal is a stronger position in the marketplace and, in the best-case scenario, profitable growth.

A company can horizontally integrate in three ways:

-

Merging with another company. In this approach to horizontal integration, two separate companies come together to create a newly combined organisation. In some cases, the individual brands remain intact while sharing common operations and resources; in other cases, one brand is absorbed by another. Mergers often occur among companies offering similar products or services that have relatively equal positions in the market. JetBlue and Spirit Airlines, for example, agreed to merge in 2022.

-

Acquiring another company. A horizontal integration may also involve one company purchasing and taking over the operations of another company. The acquiring company assumes control of the purchased company, integrating staff and other resources as needed. Business leaders will often pursue horizontal integration by acquisition to procure an advantage in the marketplace. For example, Microsoft acquired Activision Blizzard in 2022 to strengthen its presence in the video game market.

-

Expanding internally. Companies may also achieve horizontal integration by strategically deploying capital in-house to expand their own presence at the same level of the value chain. A manufacturer of protein bars may decide to expand into soft drink production, for example.

Benefits and Drawbacks of Horizontal Integration

Horizontal integration by acquisition or merger can offer a number of benefits to businesses, from providing greater access to new markets to gaining a stronger competitive position in the marketplace. Some of the most significant benefits associated with horizontal integration include:

- Reduced competition. The integration of two or more companies typically results in less competition and increased industry consolidation. In some cases, a company may acquire or merge with a direct competitor, thereby reducing competition for particular products or services.

- Increased market share. Effective horizontal integration can result in greater market share for the combined company, since it often expands the number of products and services it offers.

- Expanded customer base. When companies come together in a horizontal integration effort, each one brings its own customers. If the two companies have little customer overlap and can retain customers during the strategic transaction, the integrated entity will often enjoy a much larger customer base. A horizontal integration may also open up opportunities for cross-selling new products or services to existing customers, thereby increasing profitability.

- Revenue growth. Companies that pursue horizontal integration and are able to grow their market share and customer base will often see a lift in revenues, as well.

- Improved efficiencies. Horizontal integration may empower companies to reduce overall costs by sharing technology, marketing, research and development (R&D), production and distribution resources. The integrated company may also be able to produce a greater number of products or services more cost-effectively than the two individual companies were able to achieve on their own.

- Greater product and service differentiation. A company may integrate with another business that sells different or complementary products or services, thus expanding its portfolio of offerings.

- Access to new markets. One company may merge with or acquire another company that operates in different geographic markets, offers enhanced distribution channels or serves an additional segment of the market.

- Increased market power. The larger company created through horizontal integration may have more sway in the marketplace with suppliers, partners, distributors and customers.

Despite the opportunities for profitable growth and expansion, business leaders may want to evaluate several possible downsides to horizontal integration. Potential drawbacks include:

- Operational integration challenges. Combining two companies — particularly two large companies — is no easy task. The integration of corporate operations, technologies, processes and people can be messy and can result in employee turnover, customer churn and lost value. In some cases, efforts to bring two companies together may be bumpy or fail altogether.

- Leadership or culture clashes. Vastly different leadership styles, company cultures and organisational norms can make horizontal integration difficult — or, in some cases, doom the effort.

- Reduced flexibility. As organisations grow larger, they can become less adaptable to changes in the marketplace. Big organisations can be less nimble and less able to innovate than smaller ones. For example, a smaller firm may be easier to manage and may be able to bring innovations to the market more quickly than a much larger company.

- Regulatory and legal issues. While the purpose of horizontal integration is sometimes to absorb competition, widespread industry consolidation can lead to monopolistic behaviours, like price gouging and limited choices for consumers. Business leaders engaging in horizontal integration must consider any legal and regulatory challenges that may arise from integrating, as well as the possible costs of addressing them.

- Failed expectations. The anticipated benefits of horizontal integration may not always materialise, and overhyped economies of scales may not deliver the predicted savings for the integrated organisation. In the worst-case scenario, a failed horizontal integration can destroy value for the organisations involved.

Horizontal Integration vs. Horizontal Alliance

It is possible for a company to achieve some of the benefits of horizontal integration without merging with or acquiring another company. A horizontal alliance among companies operating at the same level within an industry value chain, also known as horizontal cooperation, can also enable businesses to team up in mutually beneficial ways.

With a horizontal alliance, companies set up a strategic contract with each other to collaborate on some level, but, unlike horizontal integration, each participant continues to operate as an independent company. Companies in a horizontal alliance work together to improve their position in the marketplace, for example, by uniting to provide complementary products or services to customers; pursuing economies of scale in a certain aspect of business, like logistics or distribution; or collaborating on developing or setting standards for an innovative new product.

For example, in 2015, high-end women’s fashion brand and retailer Lilly Pulitzer forged a strategic alliance with big-box chain Target to sell more affordable, limited editions of its apparel in Target’s stores. Lilly Pulitzer was able to expand its reach and brand awareness, and Target benefited from a boost in its perceived brand value and plenty of buzz, selling out of the garments in record time. More recently, in 2022, Fox Postproduction Services in Hollywood, California, inked a horizontal partnership with Formosa Group, a post-production studio specialising in audio. The horizontal alliance brought together Formosa’s creative audio talent and Fox’s high-end sound facilities, providing expanded business opportunities for both companies.

Horizontal Integration vs. Vertical Integration

Horizontal integration and vertical integration are both ways in which a company can expand its corporate footprint by acquiring one or more companies. However, each integration strategy takes a distinct approach and involves different objectives, benefits, drawbacks and potential results.

Horizontal vs. Vertical Integration

| Horizontal Integration | Vertical Integration | |

|---|---|---|

| Direction | Integration occurs horizontally at a specific level within a value chain. For example, a retailer acquires another retailer or two suppliers merge. | Integration occurs vertically as a company expands upstream or downstream within a value chain. For example, a manufacturer acquires a downstream supplier or merges with an upstream retailer. |

| Similarities/Differences of the Companies Involved | The companies involved offer the same or similar products and services at the same level in the value chain. | The companies involved operate at the different levels of the value chain. |

| Primary Objective | Growth and expansion of the existing business and greater market share at the same level of the value chain. | Growth and expansion of the business either upstream, or downstream. |

| Potential Benefits | Reduced competition. Increased market share. Customer, market and product expansion. Greater efficiencies. Revenue growth. | Greater economics of scale. Better supply and demand synchronisation. Increased supply chain visibility. Faster time to market. Improved customer or market insight. |

| Potential Drawbacks | Reduced flexibility. Integration issues. Legal issues. Regulatory scrutiny. Culture clashes. | Significant up-front capital expenditures. Increased organisational complexity. Integration issues. Decreased focus on core competencies. Regulatory scrutiny. |

| Power Boost | The strategy can boost an organisation's power and control in the marketplace. | The strategy can boost an organisation's power and control in a value chain or industry. |

The most obvious distinction between horizontal integration and vertical integration is the direction in which the integration moves. Horizontal integration is so named because it involves a company expanding its reach within its existing level in an industry value chain — for example, a law firm acquiring another law firm or a semiconductor manufacturer merging with another chipmaker. Vertical integration, on the other hand, occurs when a company connects with a company that operates further upstream or downstream on its value chain — such as a manufacturer merging with a supplier or joining forces with a retailer to sell its goods directly to customers.

Horizontal integration and vertical integration both involve growth and expansion, but the goals differ. When horizontal integration occurs, a company aims to boost its position within its existing corner of the value chain, seeking a bigger piece of the market; an opportunity to expand its customer base, geographic footprint or product mix; or a chance to limit competition. With vertical integration, a company wants to grow beyond its current core competency and acquire a foothold further up or down its value chain for the purposes of greater control or visibility.

Examples of Horizontal Integration

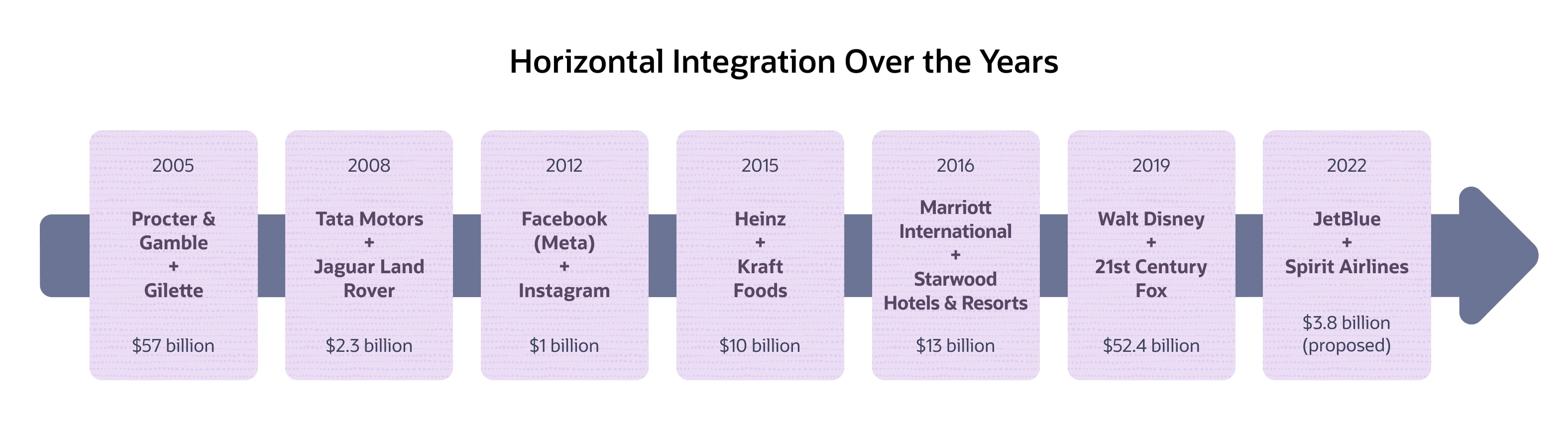

Most mergers and acquisitions that occur between companies in the same industry are considered horizontal integrations. A wide variety of industries have seen horizontal integrations — successful and otherwise. Some well-known recent examples of horizontal integration include:

2022: JetBlue’s proposed merger with Spirit Airlines

With limited opportunities for rapid expansion in the airline industry, the merger could fuel the ability of the two airlines to compete head-to-head with bigger carriers. JetBlue officials have said they expect the proposed merger with no-frills air carrier Spirit Airlines to yield $700 million in annual savings and estimated that the combined airlines may produce about $11.9 billion a year in revenue.

2019: Walt Disney Company’s acquisition of 21st Century Fox

Announced in 2017 and finalised more than a year later, Disney’s goal with its $52.4 billion purchase was to grow the company’s content and entertainment products, increase its direct-to-consumer streaming offerings and expand internationally. Disney had previously completed a horizontal integration (via acquisition) with Pixar in 2016.

2016: Marriott International’s acquisition of Starwood Hotels & Resorts

When Marriott paid $13 billion for rival Starwood, it created the world’s largest hotel company. The horizontal integration combined Marriott’s strong presence in the luxury, convention and resort segments of the hospitality industry with Starwood’s broader international footprint. The move was widely regarded as successful, resulting in more choices for consumers, increased opportunities for employees and additional value for shareholders.

2015: Heinz’s merger with Kraft Foods

The horizontal integration of Kraft Foods and Heinz, in a deal valued at $46 billion, created one of the largest food companies in the world. But the results were less than stellar. As a 2019 New York Times article pointed out, the post-merger company faced slumping sales, shareholder lawsuits, layoffs and questions about its accounting practises.

2012: The Facebook (Meta) acquisition of Instagram

The rationale behind Facebook’s billion-dollar acquisition of photo-sharing social media platform Instagram is a tale as old as business: Instagram was becoming a competitive threat. The company paid a high price to neutralise the competition, but the strategy has reaped rewards. In 2022, Instagram was responsible for 41.5% of Facebook’s revenues, as its ad revenues outpaced those of Facebook, which were in decline.

2008: Tata Motors’ acquisition of Jaguar Land Rover

The auto industry is riddled with storeys of failed horizontal integration efforts, like the Daimler-Benz purchase of Chrysler. But an integration that industry experts may have had little faith in initially, Tata Motors’ acquisition of British luxury brand Jaguar Land Rover, proved to be one of the industry’s more successful. India’s Tata Motors oversaw the turnaround of JLR and benefited from its European manufacturing sites in Europe, as well as the implementation of JLR’s state-of-the-art R&D centers in its core businesses.

2005: Procter & Gamble’s acquisition of Gillette

Consumer packaged-goods giant P&G completed its largest acquisition to date when it closed its $57 billion purchase of Gillette. Experts point to this horizontal merger as a prime example of how the strategy can deliver economies of scale, since the combined entity was able to significantly reduce research and development and marketing costs for its products.

Is It Time to Integrate Horizontally? Your NetSuite Data Can Tell You

When it comes to deciding whether to integrate horizontally, business intelligence, supported by enterprise data collection and analytics, can inform decision-making, providing greater visibility into acquisition and merger opportunities and allowing teams to negotiate the best terms for improving the success of integrations.

Companies that implement enterprise resource planning (ERP) software that brings together financial, operational and other pertinent data have an advantage in assessing horizontal integrations. These businesses are able to collect and analyse data and insights across multiple business functions to help leaders jointly determine which horizontal integration opportunities make sense for the company. In addition, companies that have invested in cloud-based enterprise systems are poised for smoother horizontal integration transitions.

NetSuite ERP is an integrated, cloud-based business management solution that gives businesses real-time visibility into operational and financial performance within a single suite of applications. Keeping accounting, inventory, production, supply chain and warehouse operations data in one place helps decision-makers identify new opportunities for horizontal integration and better measure and analyse performance following a horizontal merger or acquisition.

Horizontal integration can enable growth for companies across industries, but successful horizontal integration is far from guaranteed. It requires the business leaders involved to figure out the best ways to combine operations, cultures and leadership approaches; navigate potential legal issues and regulatory scrutiny; and diligently pursue the outlined goals of the proposed merger or acquisition. When the strategy is well-thought-out and executed, however, horizontal integration can offer companies the ability to expand, diversify and optimise in ways they may not have accomplished on their own. Companies with high visibility into their own performance and that of their targets, along with access to integrated data analytics, will be best equipped to explore the opportunities and reap the benefits of horizontal integration.

#1 Cloud ERP

Software

Horizontal Integration FAQs

What are the different types of horizontal integration?

A company can horizontally integrate by either acquiring or merging with a similar company at the same level in its value chain. Companies can also form strategic partnerships, called horizontal alliances, that can offer similar benefits while allowing both companies to continue to operate independently.

What companies are horizontally integrated?

Many mergers and acquisitions are examples of horizontal integration, whereby one company merges with or acquires another similar company operating at the same level in a value chain of a particular industry. Examples may include a women’s clothing retailer acquiring another retailer or an airline merging with another air carrier. Some well-known recent examples of horizontal integration include Walt Disney Company’s acquisition of 21st Century Fox, Marriott International’s acquisition of Starwood Hotels & Resorts and the Facebook (Meta) acquisition of Instagram.

Why do companies do horizontal integration?

Horizontal integration occurs when a company acquires a competitor or related business, expanding its footprint in its core competency. The main purpose of horizontal integration is typically a strategic aim to expand within a specific area of a value chain to dominate the competition. A shoe retailer may buy another chain of shoe stores, for example, to eliminate competition, expand into new geographic markets, acquire more customers or increase overall sales. Other benefits of horizontal integration may include increased market power over distributors or suppliers, greater product or service differentiation and greater economies of scale.

What are vertical and horizontal integration?

Vertical integration involves the acquisition of a key component of a company’s supply chain, either upstream or downstream from its own core competency. For example, a manufacturer may acquire a retail company so that it can control not only the process of producing certain goods, such as designer handbags, but selling the bags as well. Companies pursue vertical integration for a number of reasons, including the potential for increased control, reduced costs or improved profit margins. When a company takes over an upstream step, such as a manufacturing business taking over sourcing of raw materials, the company is completing a backward integration. When a company brings a downstream step in-house, such as a manufacturer that opts to open retail or ecommerce direct sales channels, the company is involved in a forward integration. A company may also pursue a balanced integration approach, expanding its reach in both directions.

Horizontal integration, on the other hand, takes place when a company acquires a competitor or related business, expanding its footprint within its core competency horizontally across its current level in the value chain. A grocery chain may buy a rival chain to, say, eliminate competition, expand into new geographic markets or increase overall sales.

What is an example of horizontal integration in history?

Any acquisition or merger involving two similar or complementary companies operating at the same level in a value chain is an example of horizontal integration. While rudimentary forms of horizontal integration likely predate recorded accounts, business historians often point to the merger of Andrew Carnegie’s Carnegie Steel with several other steel companies owned by banker JP Morgan in 1901 to create U.S. Steel as an early illustration of horizontal integration. The resulting mega-company was capable of much greater efficiency and profitability than its competitors. More recent examples of horizontal integration include Walt Disney Company’s acquisition of 21st Century Fox, Marriott International’s acquisition of Starwood Hotels & Resorts, and the Facebook (Meta) acquisition of Instagram.